1H24 Space Industry Activities: More Launches, Less Launched?

An announcement and disclosure: I just became a market research consultant to GITAI. It’s exciting for me because the company works in space robotics. Space robotics interests me, and my work should be able to aid the company in the process. It also means, however, I probably won’t go into much detail about some of the things GITAI is working on, until things get published by them, etc.

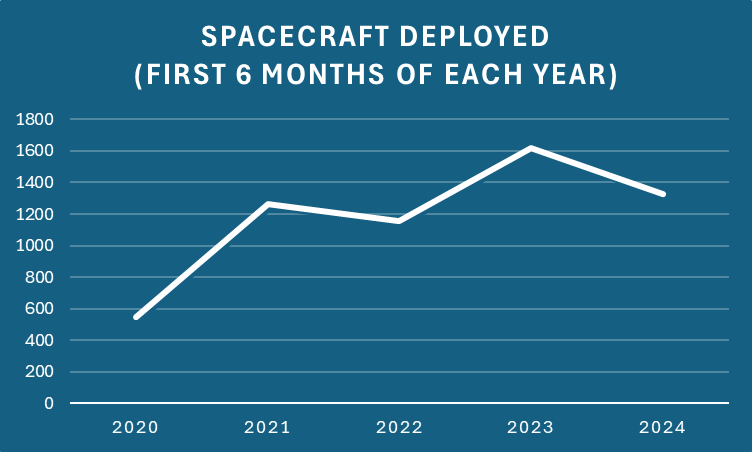

After July 4 has come and gone, it’s time to review some space industry numbers generated from the first half of the year: total successful orbital launches, spacecraft deployed, nations deploying spacecraft, rideshares, and estimated mass. These will be from January 1, 2024, through June 30, 2024. A few numbers won’t be surprising, but some might, especially when compared with the previous year or the previous four years. These numbers will also guide towards answers to some questions raised earlier in 2024.

More Launches and Mass than Ever

The biggest nonsurprise is that successful orbital launches conducted by mid-2024 exceeded 100, at 122. That’s more (a 35% increase) than launches from the same period the year prior–91. That’s also more (in six months) than the total successful launches conducted annually through 2020. Unsurprisingly, it’s the most launches conducted during the first six months of each year during the last five years.

Two major launch providers, Arianespace and ULA, contributed little to no orbital launches during 2024’s first half. SpaceX-conducted orbital launches, however, made up for their launch deficits, increasing nearly 56% from 43 in 2023 to 67 launches during the same period in 2024 (not counting the suborbital Starship launches). Rocket Lab conducted an equal number of launches in the first six months of 2023 and 2024–eight.

China’s launch providers also increased their launches during the first half of 2024. However, their increase was more modest, from 24 in 2023 to 30 in 2024, a 25% increase. Russian launches fell from 19 to 8 (a ~58% decrease) during the same periods.

Projected launches for the remainder of 2024 might be ~35% more than total launches conducted in the year's first half. The two years before 2024 each saw about a 35% increase in successful orbital launches from the year's first half to the second half. 2021 saw nearly 30%, and 2020 saw 53%. Whatever the percentage increase, chances are good, based on the previous four years, that there will be more launches conducted during the second half of 2024 than in its first six months.

Does this mean that SpaceX could reach its goal of 144 launches for 2024? After all, the trends point toward total launches for 2024, breaking launch records again at an estimated 280+. During the second half of 2023, SpaceX managed to launch ~123% of the 43 launches it conducted during the first half of 2023. If it got close to that percentage for the second half of 2024, it would have exceeded its launch goal for that year.

Increased orbital launches in the first half of 2024 led to an increase in the total estimated mass deployed into space compared to the first half of each of the four years leading up to 2024: ~1.1 million kg. It’s an 83% increase from 2023’s total estimated mass and more than double the mass deployed to orbit in 2022. The total estimated mass deployed during the first six months of 2024 nearly equals 2019’s, 2020’s, and 2021’s aggregated mass deployed during the same period.

If mass deployments for the second half of 2024 equal the first half, over 2 million kg of mass will have been deployed for the year. However, if launches increase worldwide, as they have done each second half of the four years leading up to 2024, then significantly more mass could be deployed for the year.

Those were all the increases for the first half of the year. The remaining three statistics showed some backsliding, which are all likely related.

Industry Regressions: Spacecraft, Rideshare, Variety

Fewer spacecraft were deployed in 2024 than in 2023. For the first half of 2024, nearly 1,330 spacecraft were deployed (vs. ~1,615 in 2023). Some readers might have expected this, but the overall increased mass deployed into space contradicts that statement. The contradiction is easily explained; unsurprisingly, the explanation primarily involves SpaceX.

The company had been launching about 50 Starlink satellites per Falcon 9 launch early in 2023 but also started launching larger-mass Starlink satellites that year. SpaceX can only fit about 20 of the high-mass Starlink satellites on a Falcon 9 and has been launching only those larger satellites in 2024. SpaceX must launch about 2.5 Falcon 9s to deploy high-mass Starlink satellites in an equivalent number of a single Falcon 9 launch deploying lower-mass Starlinks in early 2023.

Since the company launched only 66 Falcon 9s through June 30, 2024 (vs. 41 in 2023), it has yet to match its initial 2023 satellite deployment rate. That is why fewer spacecraft were deployed in the first half of 2024 than in the first half of 2023. However, there’s another reason for deploying fewer spacecraft in 2024 so far compared to the same timeframe in 2023: fewer rideshare missions.

Rideshare missions for the first half of 2024 fell from 11 in 2023’s first six months to seven. That’s the lowest number of rideshare missions for the first half of any year since 2020—a close look for reasons why yields the possibility that SpaceX might yet again be impacting this area. In 2023, the company conducted three complete rideshare missions (deploying over 220+ satellites) from January 1 through June 30. But, during the same period in 2024, the company performed only one entire rideshare mission, deploying a little over 50 satellites.

There are some possible reasons why fewer SpaceX rideshare missions were conducted earlier in 2024. Maybe there aren’t as many customers for rideshare launches as I believed. Maybe SpaceX is prioritizing its Starlink launches over its rideshare customers. After all, who else will those customers approach for launch services? Maybe SpaceX is making no profit off of rideshare launches.

There’s also the lack of other rideshare competitors. India’s Polar Satellite Launch Vehicle (PSLV), for example, was a rideshare workhorse, launching over 100 satellites from one launch at one point. But customers seem to be shunning the PSLV for some reason. The transition away from those types of rideshare missions also seems to have occurred as NewSpace India Limited took the commercial reins from the India Space Research Organisation. However, this recent article makes it sound as if SpaceX’s Rideshare program has taken the wind out of India’s PSLV sails.

The lower rideshare numbers and few rideshare providers result in fewer satellites being deployed from various nations.

In the first half of 2023, 45 nations deployed spacecraft of one kind or another, but for 2024, only 26 nations have deployed spacecraft. Chances are high that fewer rideshare missions impacted that number. The only year during the four years prior with a lower number of nations deploying satellites during the first half of the year was 2020, with 12. It might have been that low because of COVID-19, but 2024 doesn’t have that excuse.

It’s also unclear if less customer diversity is a sign of things to come. It may be that in 2024, more spacecraft customers deploy their satellites than ever despite low first-half numbers. It is clear that SpaceX is somewhat impacting this diversity, whether for its own or market reasons.

The first half of 2024 is a bit of a mixed bag for space industry activities. More launches have been conducted, which in turn have deployed more mass. However, fewer spacecraft have been deployed, probably because there were fewer rideshare launches. There is also less diversity among the nations using spacecraft this year. While 26 nations deploying spacecraft is better than 12, it’s only slightly more than half of those deployed during the same period in 2023. Whether this bounces back during the remainder of 2024 is unclear.

If the market can’t supply enough customers, potential newcomers entering the launch market (especially the more expensive smallsat-dedicated launchers) will face a challenge. On the other hand, if SpaceX is the bottleneck (even if it is launching more often), competitors can’t enter the market soon enough.

If you liked this analysis (or any others from Ill-Defined Space), I appreciate any donations (I like taking my family out every now and then). For the subscribers who have donated—THANK YOU from me and my family!!

Comments ()