2Q21 Orbital Space Launch Review

A minor update of the launch service provider activities during 2021’s second quarter. The upshot: it was busier than 2021’s first quarter. Where are the first quarter breakdowns? I thought you’d never ask—they are right here.

2Q21 Launch Attempts

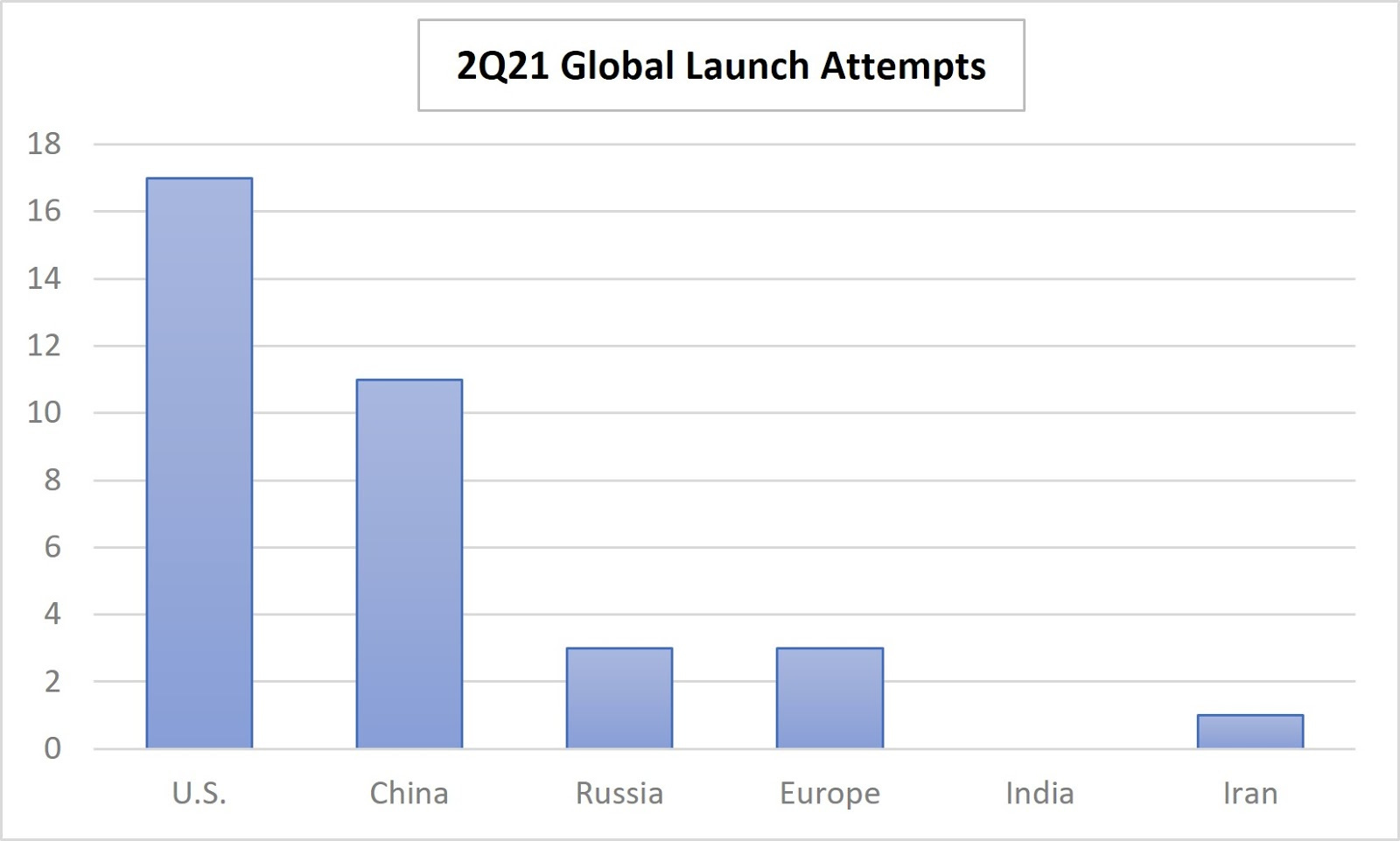

The world’s launch service providers attempted 35 launches during the second quarter of 2021 (this data comes from Gunter’s Space Page). The total includes two failures--Rocket Lab’s (a U.S. company) Electron and an Iranian military launch. The launch attempt breakdown by country for the second quarter is below:

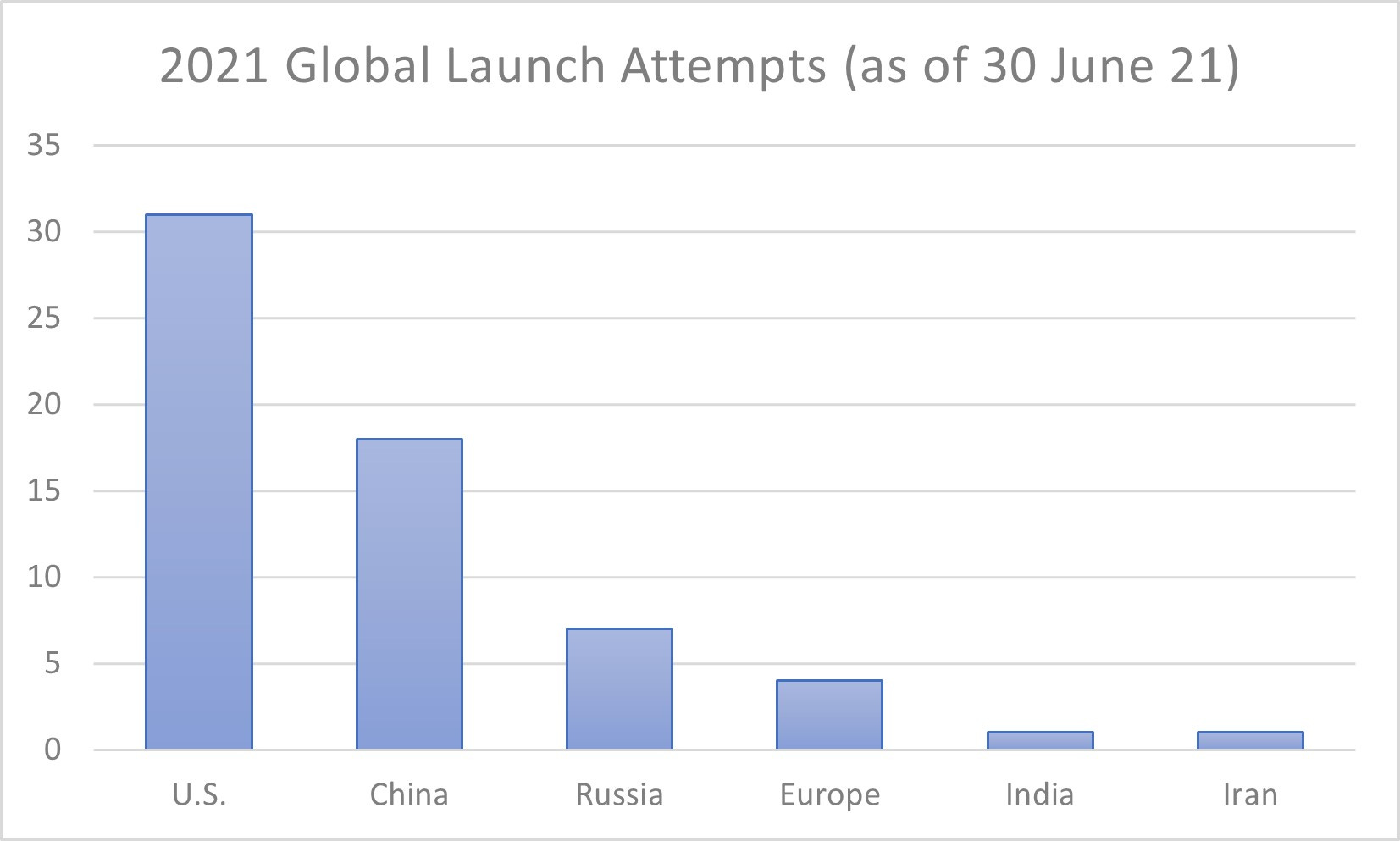

The country breakdown for total launch attempts from 1 January through June 30, 2021, so far is:

That puts the total launch attempts at the year’s halfway point at 61, about 54% of 2020s launch attempts. U.S. companies are responsible for slightly more than half of 2021's launches.

As in the first quarter of 2021, Japan’s launch providers still haven’t launched any rockets. Absent for this quarter as well was any Indian launch. Again, Iran’s single launch was a failure...remarkably incompetent given the nation’s decades-long rocket launch efforts. Europe finally launched a rocket from its Kourou, French Guiana, facility--a Vega smallsat rocket. The other two Arianespace-sponsored Soyuz launches were conducted from Vostochny in Russia.

The United States launch service providers are keeping U.S. launch totals ahead of China’s efforts. For the second quarter, the U.S. launch total was merely 6 launches ahead of China’s 11 launches. However, U.S. launches for the second quarter are nearly 6 times that of Russian or European launches, which were three apiece.

2Q21 Launch Providers

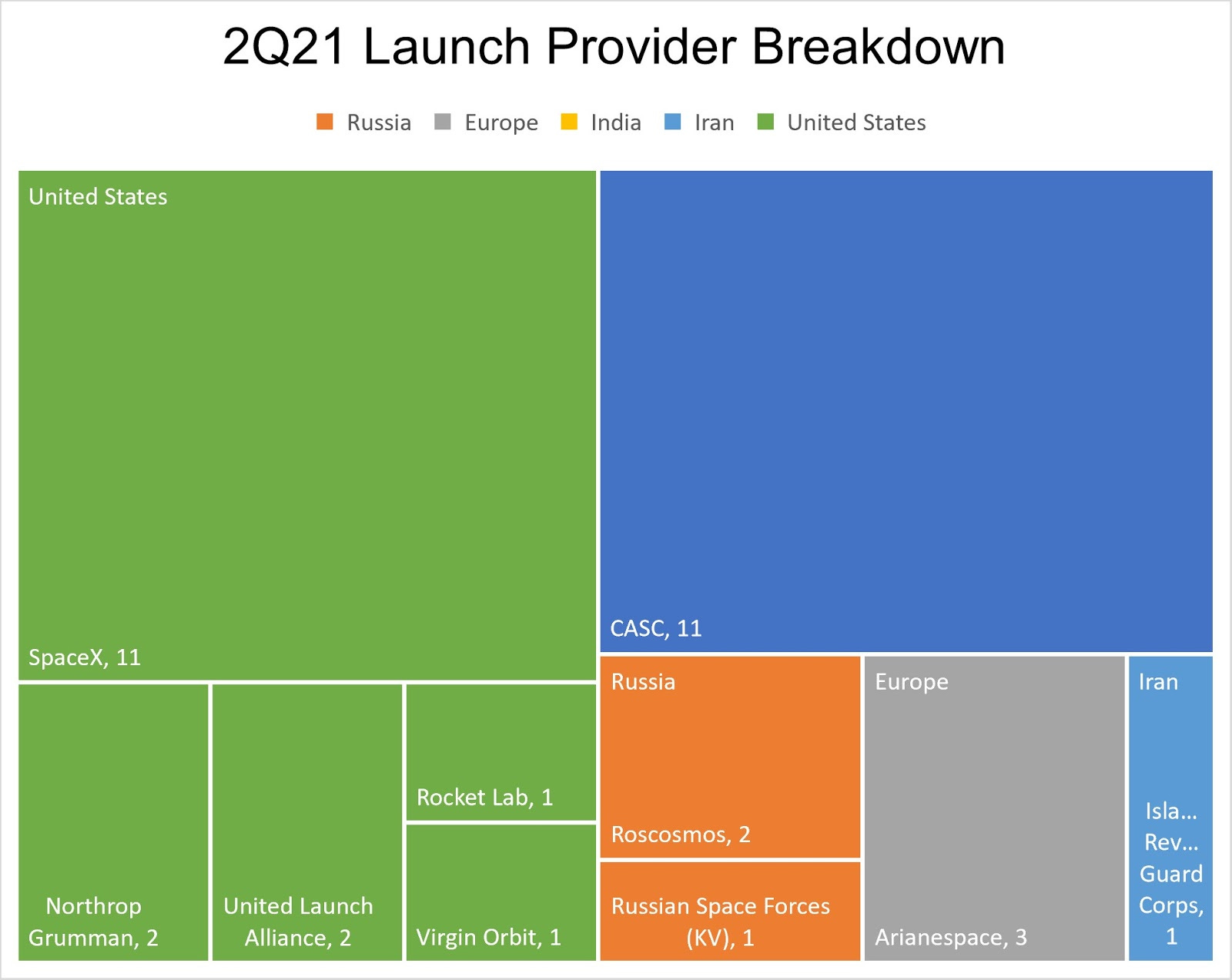

Breaking down the activities of each launch provider in each nation gives us this nice little box chart:

As an obvious observation, the launch service provider ecosystem in the U.S. appears more distributed than those of the other nations. To be clear, other nations do use a variety of rockets from different manufacturers but tend to funnel activities through a single launch service provider. These relationships are why we see Arianespace launching Russian-made Soyuz, the (primarily) Italian-made Vega, and the French Ariane 5.

SpaceX managed to launch nearly four times per month for the last three months. Of its eleven launches, six were dedicated for its Starlink constellation efforts. Note that a single private company’s launches equaled China’s nationally-sponsored launches (although SpaceX’s launches were nearly double China’s in 1Q21). But we still see alarmist and uninformed “news”/opinions of a “space race” in which China is beating the U.S.

SpaceX is also just two launches shy of its TOTAL 2020 launches (a company record). Of the remaining U.S. companies, the United Launch Alliance (ULA) and Northrop Grumman tied each other during the quarter with two launches each. Virgin Orbit launched its air-launched LauncherOne for business a second time, but Rocket Lab’s single Electron launch during the quarter failed.

The China Aerospace and Technology Corporation (CASC) is China’s mainstay launch service provider, launching its usual assortment of CZ (Chang Zheng=Long March)7, 6, 5, 4, and 2 rockets. Of the CZ-2 launches, one was for transporting astronauts to China’s shiny, new Tianhe Chinese Space Station (which itself was launched on a CZ-5B earlier in the quarter). All CASC launches were successful.

Europe’s launch activities came down to two Soyuz launches from Vostochny in Russia and one Vega launch from Kourou in French Guiana. Russia conducted three launches, two for International Space Station (ISS) missions and one for a military mission. This brings us to the…

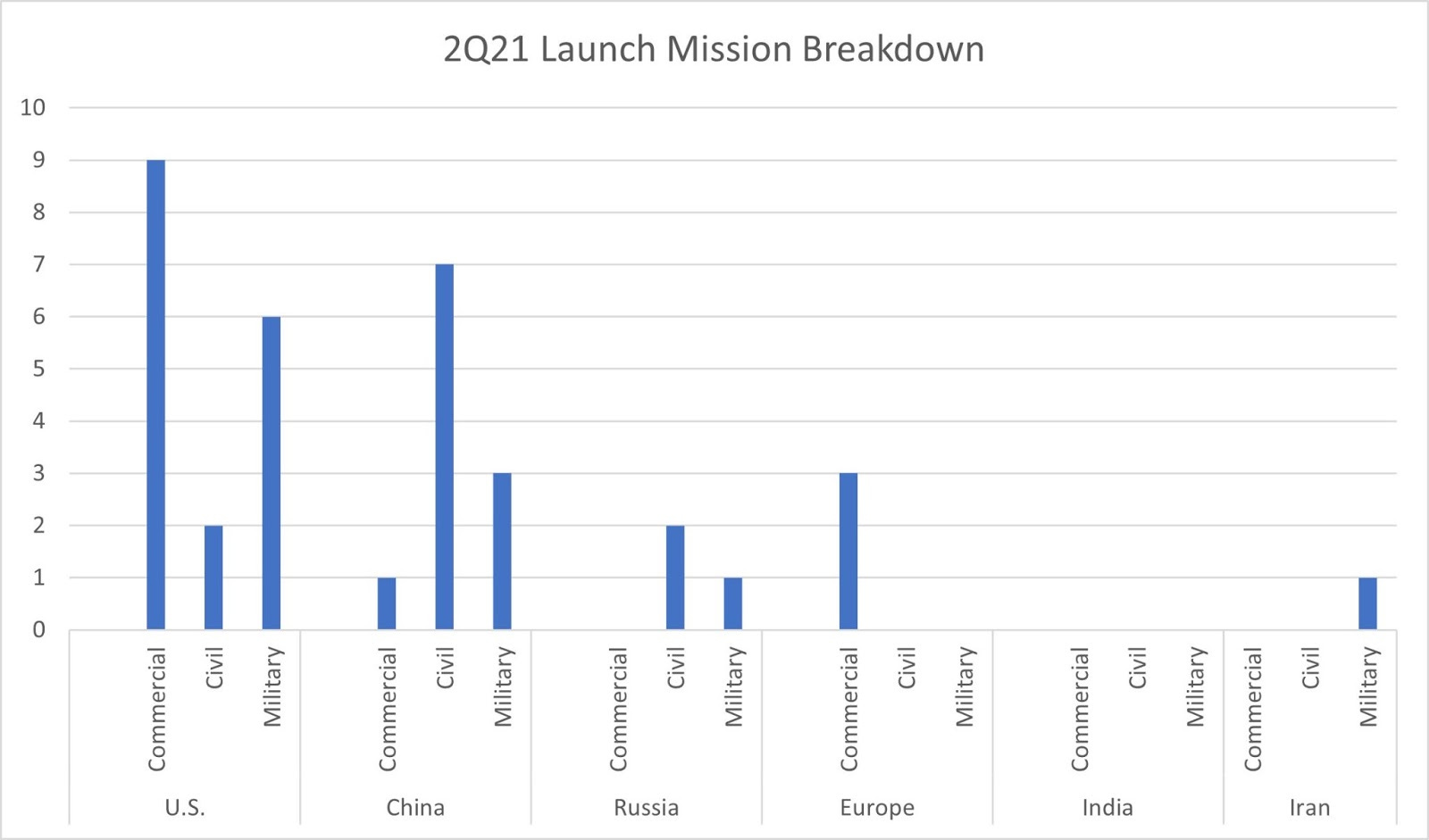

2Q21 Mission Breakdown

As noted in the 1Q21 breakdown, I’ve broken down the types of missions driving these launches into three categories (very simply defined):

- Commercial: launches of satellites with a commercial purpose (profit is the priority)

- Civil: launches of satellites with a civil purpose (government-provided public services)

- Military: launches of satellites supporting/augmenting a government’s military

For launches deploying multiple satellites, the assumption is the satellite with the most mass is likely the primary driver for the launch. The assumption means I’m relying on my judgment to determine which satellites may be the primary reason for a launch.

About 37% (13) of the world’s 2Q21 launch attempts were for commercial missions. About half of those missions were Starlink-only, with U.S. launch service providers taking about 69% of all commercial launches. This indicates that a little over half of the launches conducted during 2Q21 for commercial missions generated profit from external customers.

Civil launches (such as ISS missions) and military launches (early missile warning, etc.) were tied at 11 launch attempts. Both of the latter mission categories experienced increased launch activity from the previous quarter. Of the six U.S. military launches, two were launched by ULA, two by Northrop Grumman, one by Virgin Orbit, and SpaceX. SpaceX launched both U.S. civil launches, which were for ISS missions.

Overall, while there were nearly 30% more launches from 1Q21’s launch activities, SpaceX’s 2Q21 launch activities, which nearly averaged four launches per month, only increased by one. China’s launch activities during the second quarter were nearly double its first-quarter activities. Three of China’s launches were for its Chinese Space Station activities (the module itself, a support module, and a crew capsule).

But European and Russian launch activities averaged one launch per month during 2Q21 (it may be notable that the majority of Russia’s launches during 2Q21 supported the ISS). Iran’s launch could be seen as a “notice me, I’m here” kind of launch, as it did nothing but keep Iran’s launch program on the U.S. intelligence and diplomacy radar. Again, it’s almost laughable how long that nation has attempted launches versus how often it has succeeded. The seeming absurdity of these attempts is why I believe the Iranian launch itself, even if it was a failure, was successful in a different way.

All of these launches indicate a lot more satellites were deployed during 2Q21 than 1Q21. We’ll see if that’s true in the subsequent analysis.

I am just letting everyone know that this month is getting a little busy. I may have to delay the next analysis a week or two.

Comments ()