3Q21 Spacecraft Deployment Review

This is a review of the number and types of spacecraft deployed into (and occasionally beyond) the Earth’s orbit during the third quarter of 2021. The term spacecraft includes satellites of all types, the probes sent beyond Earth’s orbit (satellites with a different focus), and cargo, crew, and passenger transports inserted into the Earth’s orbit. For those readers looking for a review of the rockets that launched and deployed these spacecraft during 3Q21, please reference the “3Q21 Orbital Space Launch Review.”

Much of the data used in this review comes from Gunter’s Space Page and Space-Track.org, both of who have graciously made it available--free of charge--to the public. Additional data comes from my own research and knowledge about the spacecraft deployed during the quarter.

A Small Dip

While orbital rocket launch attempts remained about the same during 3Q21 when compared with the previous two quarters, the number of satellites each launch deployed shrunk significantly. In 1Q21, about 720 spacecraft were deployed and in 2Q21 570 were deployed. During 3Q21 only 204 were deployed--less than half of 2Q21’s total. Even so, the total number of spacecraft deployed during 2021 so far (~1554) exceeds 2020’s total (~1230). And there’s still a quarter of the year to go.

A difference from the previous quarter’s deployments is SpaceX’s slowdown with its Starlink satellite deployments during 3Q21. The company had deployed only 51 of its Starlink satellites during the quarter, down from the 355 satellites it deployed during the previous quarter. Subtracting those 51 Starlink satellites from the 204 total spacecraft deployed during 3Q brings the total down to 153. However, OneWeb, a Starlink competitor, deployed 104 satellites during 3Q21.

Russia managed to launch one satellite less than during 2Q21, from three to two.

As during the previous quarter, in 3Q21, three nation’s launch organizations and one European company launched and deployed all spacecraft: China, Europe, Russia, and the U.S. However, the share distribution is a little strange, as European launch company Arianespace was responsible for launching and deploying 55% of all spacecraft deployed during 3Q21. The high share is largely because the company used Russian Soyuz rockets to launch OneWeb satellites, even as Arianespace launched fewer rockets than the U.S. or China during 3Q21.

The U.S. 29% share is primarily because of the 51 Starlink satellites deployed during the quarter, while China’s share of 15% is not dependent on any single satellite operator. Russia’s 1% share was higher this quarter than the previous quarter’s, but that is only because there were significantly fewer launches during 3Q21.

Neither India nor Japan launched anything during 3Q21.

China’s share of satellite operators would seem to not make sense when compared to the overall launches its launch services conducted during 3Q21 (17). But that difference can be explained by their humble use of rideshare missions, which topped out at about five to six satellites for a few launches during 3Q21. Compared with the 34+ satellites on a Soyuz and the 51 satellites on a Falcon 9, China’s rideshare launch services are not as capable yet.

3Q21 Satellite Operator Breakdown

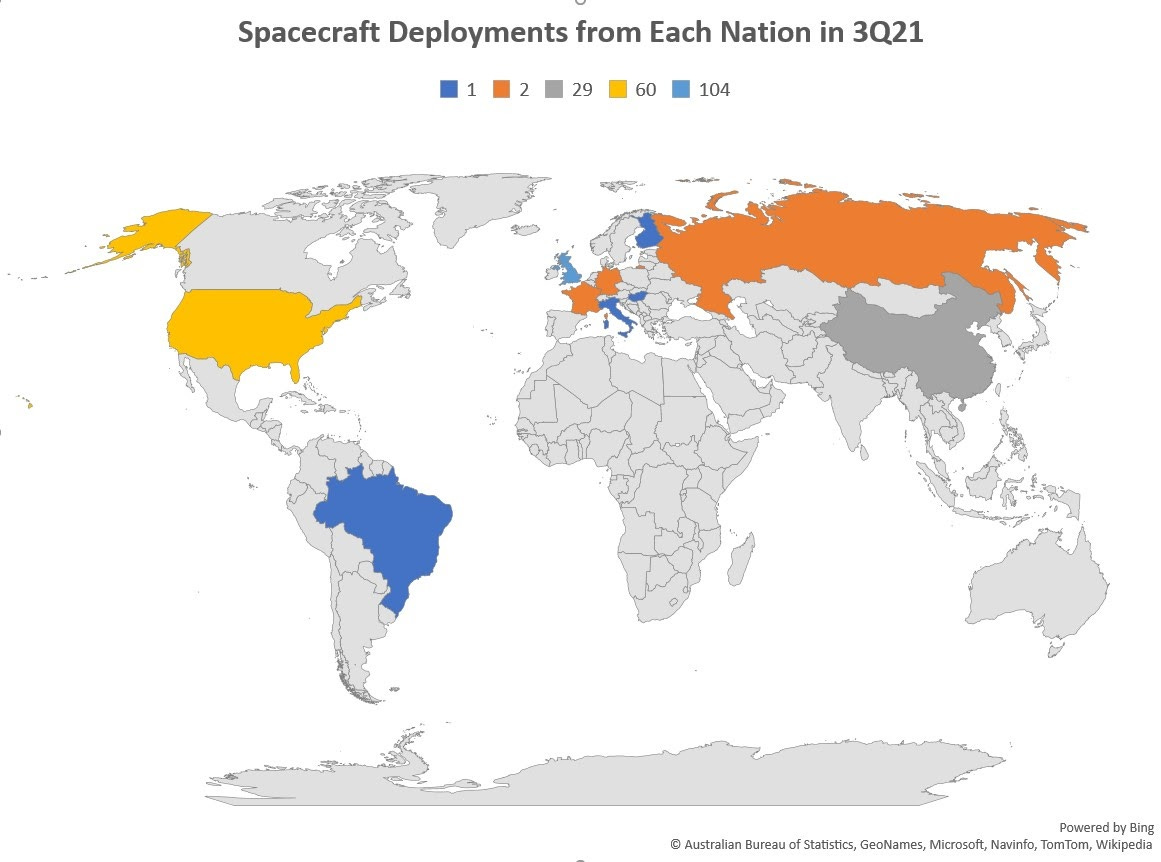

Spacecraft operators from 10 nations and ESA deployed a total of 204 spacecraft during 3Q21 (11 nations less than the previous quarter). European satellite operators deployed 111 satellites during 3Q21, while U.S. operators deployed slightly over half the European total with 60 spacecraft. China’s satellite operators deployed 29 spacecraft during the same period. Russia’s operators deployed 2 spacecraft.

U.K.-based OneWeb deployed the most satellites during 3Q21 at 104. SpaceX had the second-highest number of deployments, with 51. No other company deployed more than five satellites during 3Q21.

3Q21 Satellite Mission Breakdown

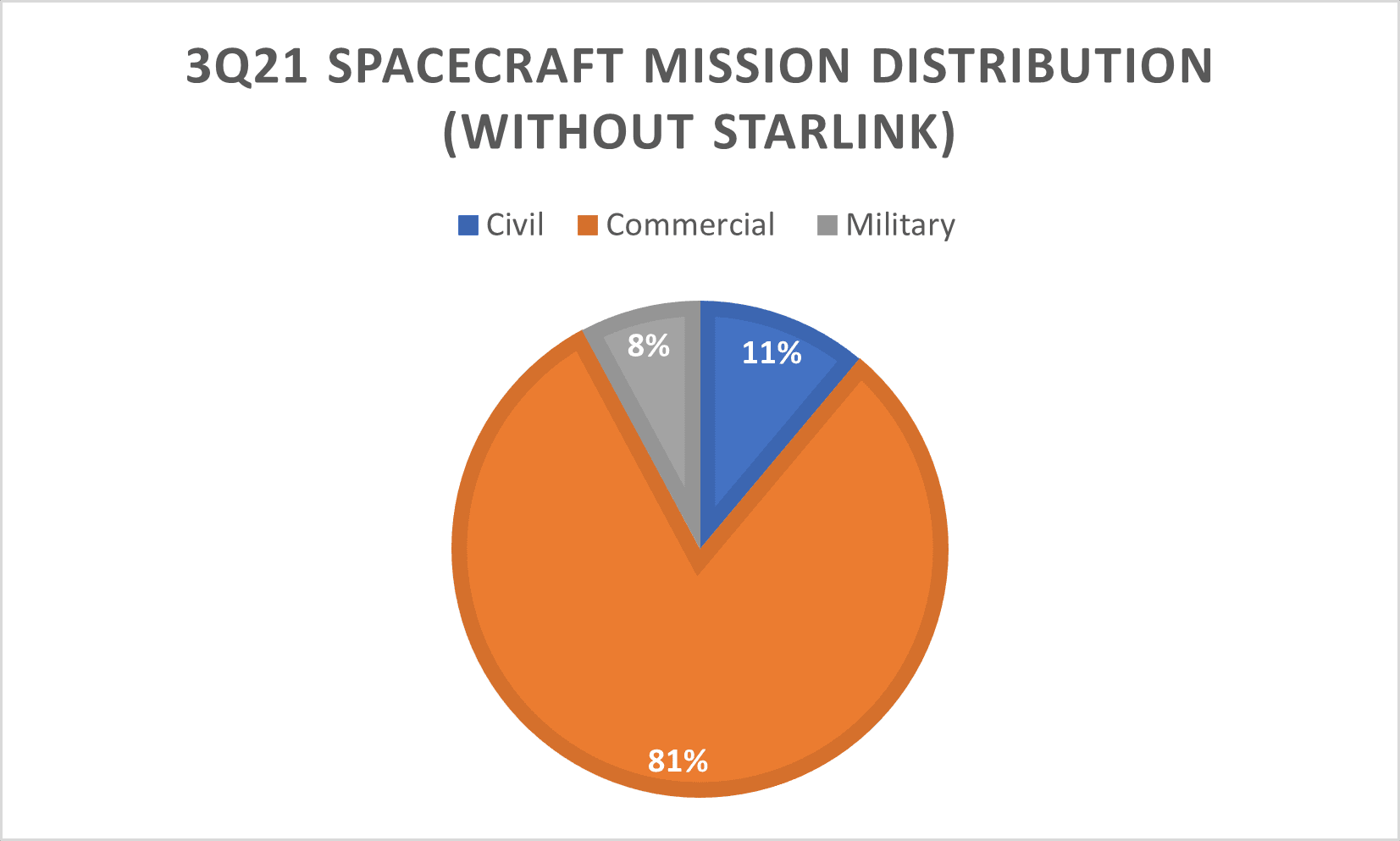

Because I am a simple person, I define the three mission categories very simply:

- Commercial: satellites with a commercial purpose (profit is the priority)

- Civil: satellites with a civil purpose (government-provided public services)

- Military: satellites supporting/augmenting a government’s military

Using those definitions allows me to break down the distribution into a nice little pie chart (below):

While SpaceX didn’t deploy many Starlink satellites, I will still provide an alternate distribution chart below (the result of subtracting 51 Starlink satellites).

With or without Starlink, most spacecraft deployed were for commercial ventures, with over 80% of all deployments during 3Q21. So while it’s an increase in share, the increase is primarily because the overall total of spacecraft deployed decreased from previous quarters.

Year-To-Date (as of September 30, 2021)

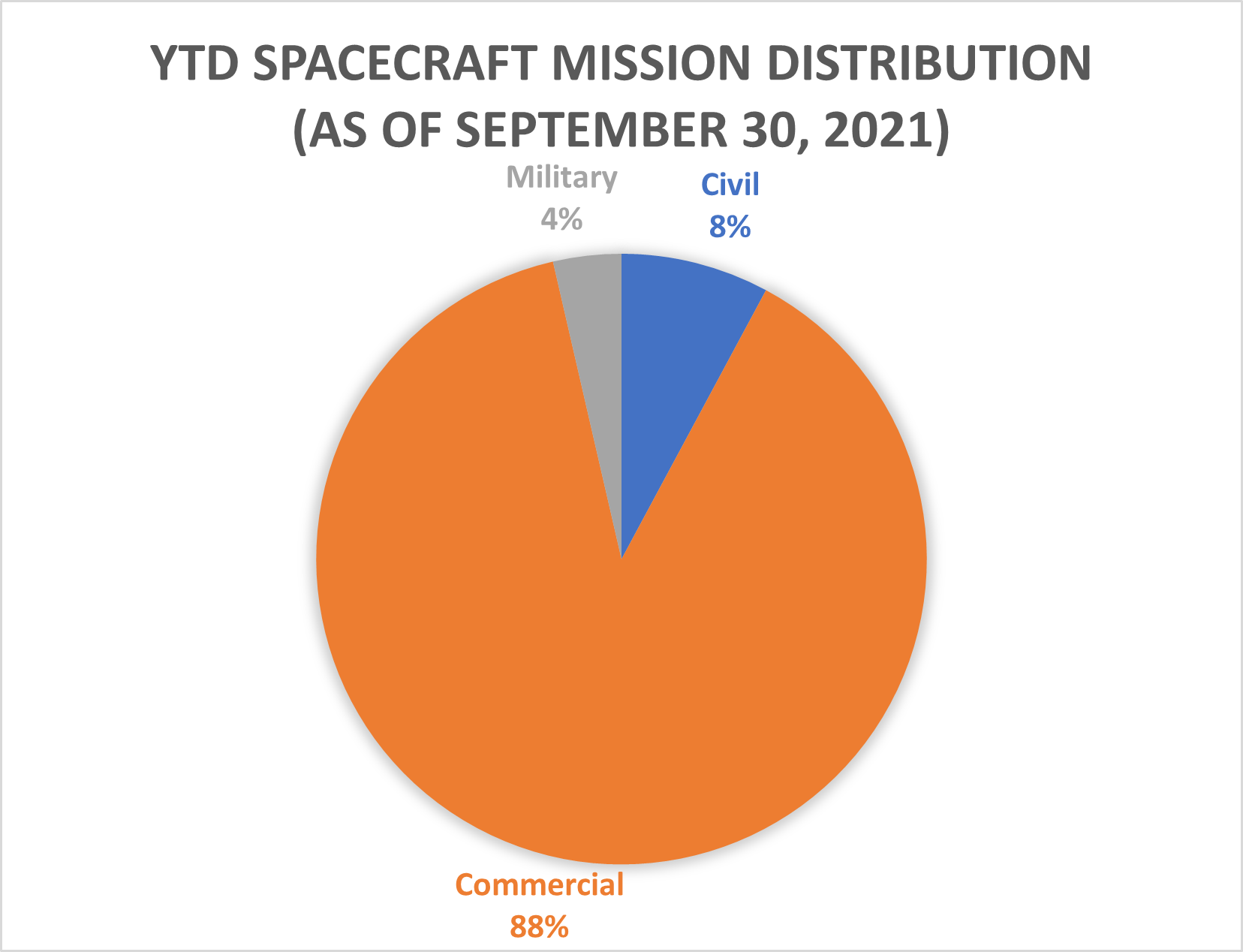

While there were significantly fewer spacecraft deployments during 3Q21, the overall total for 2021 will be record-breaking as the deployments are already exceeding 2020’s total spacecraft deployments.

Even with fewer spacecraft deployments, the commercial spacecraft operators continue deploying significant numbers of spacecraft. The primary drivers continue to be commercial communications satellites with a focus on providing broadband service. The year-to-date commercial satellite share during 2021 shrank by 1% during the third quarter, taking an 88% share, while civil holds 8% and military deployed satellites took 4%.

This dominance by commercial spacecraft operators in the number of spacecraft deployed doesn’t mean they are profiting as much as those catering to military and civil missions. Data still points to, at least in the U.S., Japan, and Europe, the fact that the governments pay significantly more to spacecraft manufacturers for their products than what commercial operators pay.

Other Observations

Aggregating data from both the launch and orbital spacecraft reviews:

OneWeb’s satellite factory is producing.

OneWeb normally doesn’t outpace SpaceX in satellite production, the fact is that, aside from SpaceX, OneWeb is building satellites faster than other current satellite manufacturers. This rate allows the company to deploy 34-36 satellites each month, as it did for 3Q21. OneWeb’s satellites may not be as sophisticated as Starlink, but the factory appears to be pumping out satellites at a rate to keep up with launches.

OneWeb’s manufacturing rate and capacity could be good news for other ventures wishing to become satellite operators. OneWeb can offer to build many satellites for a **relatively** low cost (compared to legacy satellite manufacturers). And the company is showing it can build them quickly--weeks and days--instead of years and years. The only other competitor is SpaceX, which builds Starlink faster and cheaper, but not everyone likes SpaceX or has the opportunity to use its capabilities.

China: limited rideshare opportunities?

China’s launch companies appear to be limiting rideshare missions to smallsat-focused rockets, such as the CZ-6. So, while China launched plenty of rockets--seventeen of them--during 3Q21, it didn’t deploy near as many satellites as the Europeans or U.S. It may be that China’s satellite operators aren’t producing enough satellites to make it profitable to use a CZ-4 or CZ-5 (a stretch, I admit) rocket. But, on the other hand, it may be that thanks to China’s leadership politics, its commercial satellite operators are being forced to focus primarily on only China, limiting their opportunities.

Even ULA conducted a rideshare mission when it launched Landsat 9 during 3Q21. India also has put the Polar Satellite Launch Vehicle to good rideshare use. Unfortunately, China’s politics and current leadership are putting China’s satellite operators in a no-win situation. The country’s leadership and its “loyalty” policies make working with China’s satellite operators a gamble--through no fault of the operators. But, again, these policies generally limit their business, which has a global reach, to China.

Where are all the smallsats?

With the way some promoters are weaving the story, there’s a vast smallsat launch opportunity that just needs more rockets. That may be true, but at least for the third quarter, there weren’t many smallsats deployed at all. Aside from ULA’s Landsat 9 launch and Arianespace’s Pléiades-Neo launch, there weren’t many other smallsat deployments (OneWeb and Starlink excepted). China’s companies deployed quite a few smallsats during the quarter--for China.

Again, that smallsat deployment slump is only for one quarter, but there shouldn’t be a slump if there’s a thriving smallsat launch market. At least it’s a slump until it maybe continues through the next few quarters. It will be interesting to see what the next quarter brings.

Comments ()