Ample Capacity and Monopoly Markets: the U.S. Space Launch Paradox

Are you interested in commercial space stations? Then you might want to read an article I wrote for Astralytical: “Commercial Space Stations: Orbit is Only the Beginning.” Some challenges for burgeoning commercial space station companies are obvious, but answering those means nothing if customers can’t get to space stations, to begin with.

A Tale of Two Charts

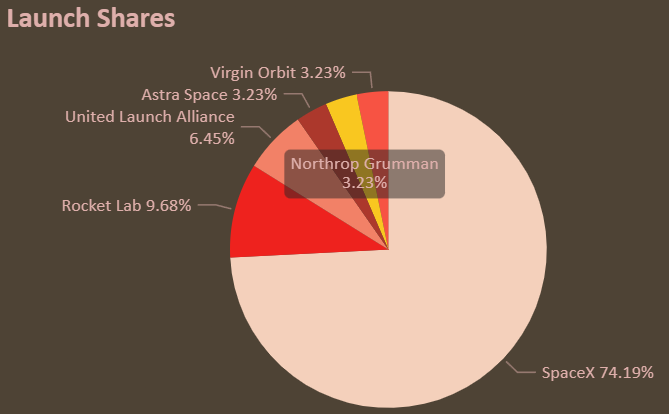

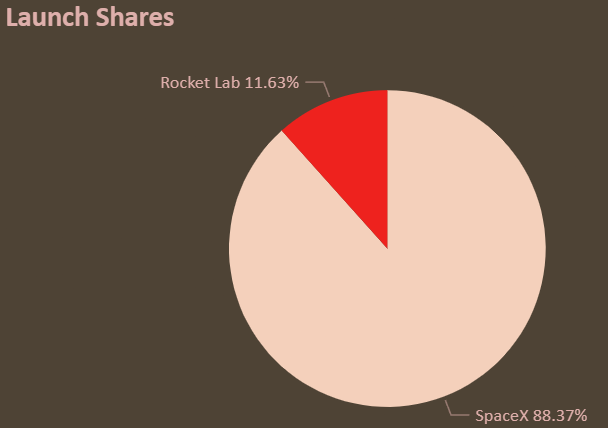

I’ve been working in the world of data for the past few weeks. Some of what I’ve dug through is depicting a situation that I was somewhat aware of because of the changes that have occurred during the past year. But I hadn’t thought about those changes’ impacts on United States launch companies. The pie charts below hopefully provide you with a glimpse into those impacts.

The pie charts depict the launch companies and their successful launches from the beginning of the year through June 8. The upper chart covers 2022, while the lower covers 2023. I’m leaving out the total launch numbers for later in this analysis.

The data shows a drop in the number of launch companies conducting launches from a year ago, from six to two. Based on the events that occurred during the past year, the drop may not come as a surprise to some readers.

The Road to Monopoly

For example, Virgin Orbit tried one rocket launch early in 2023, which failed (which is why it’s not included in the charts). It later filed for bankruptcy and won’t be launching anytime soon. Astra is another example–in 2022 the company’s Astra 3.3 launch was a rare success for the company. However, it attempted a launch in June later that year, which failed and the company hasn’t conducted any other launches since then. While Astra continues pushing the notion it will re-enter the launch business, it seems to be waffling on what it actually wants to do.

Northrop Grumman hasn’t launched an Antares since November 2022. The Antares relies on suppliers from Russia and Ukraine, which has pinched Northrop’s rocket supply. The company had noted it had enough completed first stages for two more launches. It also entered into an agreement with Firefly Aerospace in which Firefly would supply engines to Northrop for an updated Antares. Added together, the company can only conduct one more Antares launch, which it’s scheduled to do in July 2023. After that launch, it must then use its updated rockets relying on an engine with no reliability history.

Then there is the United Launch Alliance (ULA). The company had planned to have a rocket (the Vulcan) to replace its older systems. But it had expected to have rocket engines for Vulcan much earlier than when Blue Origin finally shipped them. And even those engines seem to be causing some delays in ULA’s Vulcan launch plans. In the meantime, the company has not launched in 2023 yet. ULA launched two Atlases during the same five months in 2022.

ULA is supposed to have 19 more Atlas V launches lined up over the next six years. The next launch was targeted for July 2023. However, the mission slated for that launch was the first crewed flight of Boeing’s Starliner, which just got delayed again–possibly indefinitely according to the reporting. That, and six other Starliner launches, made up a third of the remaining Atlas V launches. Perhaps the eternal delay will force ULA to distribute those Atlas V’s to other customers. But the delay means that ULA will not launch any Atlas V’s for another three months.

It will, however, launch one of two remaining Delta IV Heavies in June 2023.

The remaining launch companies, Rocket Lab and SpaceX, have kept launching during both periods, increasing launches from 2022 to 2023. Rocket Lab launched three Electrons during that time in 2022 and five from January through May 2023. SpaceX conducted 23 launches in 2022 and 37 (it's supposed to be 38 SpaceX launches, not 37. Thank you Antonio Machado e Silva on LinkedIn for asking about the discrepancy) launches– a 61% (65%) increase from the previous year’s already impressive launch cadence–in 2023. Both appear to have plenty of launches in their manifests for the remainder of 2023.

Rocket Lab’s established launch cadence for 2023 (so far) shows that it will likely complete 15 launches for the year, up from nine in 2022.

Those 37 (again, 38) SpaceX launches in 2023 are six (seven) more than all six U.S. launch companies conducted during the same period in 2022. That 2023 monthly launch rate still indicates that SpaceX will not achieve its stated goal of 100 launches for that year. Instead, it is still on track for about 80-84 launches (which is still unreal).

Waiting for the Other Shoe

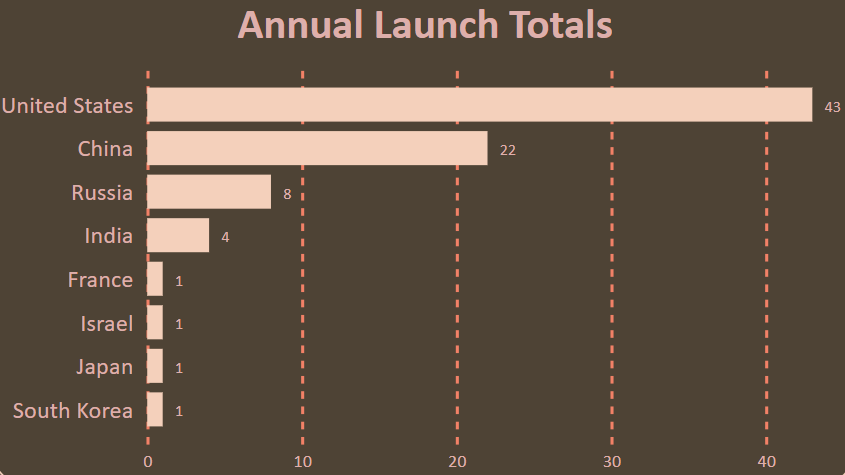

With those statistics and projections out of the way, Rocket Lab and SpaceX have conducted 43 launches in 2023, putting them far ahead of launch competitors in other nations so far (China is closest with 22). The year’s total through June 8, 2023, was more than the 31 launches conducted during the same time frame in 2022. So, U.S. launches in 2023 were up from 2022 but experienced a 67% decrease in U.S. launch companies conducting them.

2023 launches in the U.S. during the first five months equaled the annual U.S. launch total in 2020, eclipsing earlier U.S. annual launch totals as well. Together, Rocket Lab and SpaceX are fielding three different rocket systems, Electron, Falcon 9, and Falcon Heavy. China’s launch companies used 14 different rocket systems for the 22 launches from that nation during that same period.

Those 22 launches from China deployed about 50 spacecraft, a small percentage of the ~1160 Rocket Lab’s and SpaceX’s rockets deployed. However, the variety of rockets China’s launch companies offer indicates a robustness in its launch capability that a nation currently relying on three rockets can’t quite match.

Breaking the U.S. launcher data down further, there are only two companies, and both are in a monopoly position. Rocket Lab is the only one launching a smallsat-dedicated rocket in 2023 (Virgin Orbit failed), and SpaceX offers its Falcon 9 for small and large satellites and the Falcon Heavy for larger ones.

How did the U.S. launch market come to this? It certainly wasn’t a lack of favored subsidies for the competition, as ULA received more contract infusion from the U.S. government than SpaceX ever did. ULA theoretically had more name-brand recognition as well, but SpaceX’s brand still managed to surpass that. ULA had access to more launch opportunities than SpaceX for years, initially as the sole provider for large national security launches and routinely winning larger contracts than SpaceX for NSSL. Despite that favoritism, ULA lost its market share and has no rockets for new launches.

At a guess, the current U.S. launch capability brittleness may have been affected by both ULA’s and Orbital Sciences’ (at the time) attempt at deflecting reality. Both seemed reticent to move away from rockets using Russian engines. When ULA finally did, it found itself in the position of relying on a company that had yet to prove that it could build a large and reliable engine. Northrop is in a similar position in its agreement with Firefly. The strange thing, for ULA at least, is that despite this drop in launches the company is still making money, which might incentivize ULA to keep doing what it’s doing.

It’s difficult to say what it will take to make the U.S. launch market more robust. It doesn’t need quite the variety that China’s launch operators offer, but it certainly would be healthier if more than two U.S. companies were supplying regular launches. With the delays for both ULA’s and Blue Origin’s rockets, it’s hard to take either one seriously as a contributor to a healthier launch market in the U.S. However, ULA looks to be further along than Blue Origin with its rocket.

It may also be that Rocket Lab, with its Neutron, may make it to market earlier than Blue Origin’s New Glenn. Neutron is not New Glenn’s equivalent, but its upmass capability still gives Rocket Lab flexibility in the types of payloads the company can launch. Of course, Rocket Lab getting Neutron operational doesn’t fix the problem of U.S. market reliance on two companies launching regularly.

Whether ULA (or Blue Origin, or Northrop) will then launch as regularly as SpaceX depends on a few things. Can they ramp up launches quickly? Will their rockets not explode every other launch? Will one of the biggest launch customers ULA and Blue are counting on, Amazon, have satellites ready for launches? Will they be able to win other customers, especially if SpaceX can somehow squeeze those customers in an already busy launch year?

The data points to a paradox for the U.S. launch market. 2023 is the busiest it’s ever been, but two companies are the only ones launching. By launch numbers alone, the market appears healthy. However, looking deeper at the state of potential competitors and their constantly shifting plans yields an uncomfortable possibility that perhaps the U.S. launch market isn’t that healthy at all.

Comments ()