Commercial Space Growth--Venture Capital Driven

In “,,Government Space Budgets=Industry Priorities (Where’s Commercial?),” the analysis reiterated the real U.S. government’s space industry priorities. A look at the U.S. government’s annual budgets easily helps determine these, which don’t seem to match rhetoric about U.S. commercial space growth. By all accounts, and despite U.S. government spending priorities, the U.S commercial space industry is growing. Is the growth originating with investors?

Capital Ventures in Growth

There are other ways of funding a space company-- a new circumstance when compared to decades using the traditional government largess model. But are those new funding sources enough for not just growth, but market creativity and diversity?

One example of alternative funding is the involvement of venture capitalists. Early this year, the Department of Commerce’s (DoC) Wilbur Ross said the following about the commercial space industry during a ,,World Economic Forum speech:

“Today, growth in the commercial space industry is driven primarily by venture capital and private entrepreneurs. In the ,,past 10 years, more than $25.7 billion, has been invested, in 535 space companies globally. I,n ,,2019 alone, $5.8 billion, was invested ,— the largest investment year on record. Also last year, roughly 43 percent of space startup investment went to companies outside the United States, and over 70 countries now have meaningful space activities.”

Space Angels calculated the $5.8 billion total investment in 2019 Ross referenced in his Davos speech. The investment company specializes in space startups, with insight into the accumulation of equity investment into companies such as SpaceX, OneWeb, and others gained during funding rounds. It’s unlikely Ross had any particular grasp of the Space Angels’ startup calculations. He may have relied on the company’s reputation when he quoted their work.

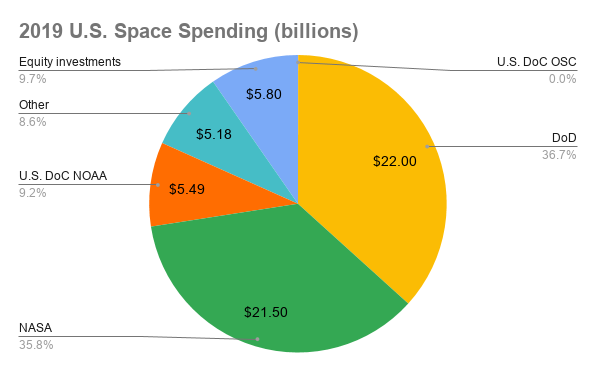

Adding that $5.8 billion of investments to the estimated U.S. government space spending share totals up to $60 billion. True, investing isn’t the equivalent of spending. But the money is mostly spent by the startups to do whatever they need to do to be successful. Much like taxes paid to the government, the invested capital is no longer available to the people who earned it--at least for a while.

Investments and Budgets Compared

Based on the $5.8 billion, it appears as if commercial space investment (spending) was less than 10% of all U.S. space spending in 2019. The total investments from venture capitalists were more than the DoC’s NOAA allocation, but only 27% of NASA’s 2019 budget. The previous ten years of venture investment of ~$26 billion is not much more than the annual budget allocated to NASA.

The estimated $54.19 billion of U.S. government space spending goes to either civil space activities (with the biggest recipient being NASA) and military space activities in the Department of Defense (DoD). NASA and the DoD are spending tens of billions of dollars on space programs, services, and commercial companies’ technologies. That would be plenty of money to provide a foundation for the U.S. commercial space industry--that focused on civil and military space.

They are paying U.S. companies for launch services, satellite manufacturing, infrastructure, communications, remote sensing, and more (possibly including investing in startups). The majority of the $54.2 billion NASA and the DoD is spending on U.S. companies is reported as part of the commercial revenues.

In other words, what was occurring with the U.S. space industry before this last decade is still happening.

Klein, aber--oho? (Small but Mighty?)

Is that $5.8 billion of investment enough to push back and shift the industry to a commercially-focused one? After all, the U.S. government department charged with fostering growth in the commercial space sector, the U.S. Department of Commerce (DoC), receives less than 1% of that $54.19 billion. The venture capitalists have invested more than what the DoC’s Office of Space Commerce is being given.

The DoC is supposed to champion U.S. commercial space business interests and growth. Tough challenges, including a dearth of funding and non-history combine with equivalently high expectations, make it difficult to see how the DoC can help. Especially when the 800 lb. gorillas, NASA and the DoD (each with 60+ years of industry experience), can push back with so much more.

Going back to the question: can private investment help the U.S. commercial space industry overcome those challenges? The answer appears to be--maybe. For example, some of the investments Space Angels tracks include money given to SpaceX and OneWeb. SpaceX seems to be making an impact, with ambitions that include, ultimately, getting to Mars. The company’s investors are probably pleased--even as the company moves into areas that weren’t in its expertise portfolio (such as satellite manufacturing and operations), but will undoubtedly become part of it.

OneWeb’s public travails, on the other hand, seem to provide some very cautionary lessons. Before its bankruptcy, it had managed to raise a few billion dollars, but not enough to keep it from going bankrupt. Since its revival, it hasn’t moved the needle on commercial satellite operations, instead, falling back on government funding to keep it alive. But OneWeb’s vision is less ambitious, too.

Despite the low (when compared to government budgets) investments, commercial space activity in the U.S. is growing. Some of the growth is because new launch services are winning large government contracts (contributing to their competitiveness and success). And while this state of affairs isn’t quite a change from the decades of government contracting with larger aerospace companies, there is at least one new factor: a company’s DNA and vision can help change things up in the industry. Even when a company is earning much less funding from VC’s (than the money handed to the government agencies), these companies are changing the U.S. space industry.

Comments ()