Dedicated Smallsat Launch: Boosting the Market?

Falling for the Clickbait

A headline like the following “Arianespace's new agreement could address Europe's rocket crisis,” inevitably raises a few questions. The questions aren’t meant to pick on the author. Nor are they a critique of Arianespace’s memorandums with Orbex and PLD Space.

They are, however, questions of the assumptions in the headline–that European smallsat launchers are the key to European launch growth and independence. That, somehow, two smallsat launchers working with Arianespace will be a tremendous boon to the European space launch industry. I’ve seen both assumptions at work in several social media pronouncements, and from the companies themselves. Maybe they will fulfill those expectations. To be fair to the author, he is unsure whether either smallsat launcher will even become operational. He might not even have written the headline.

Very recent history, however, argues against smallsat launchers as vital participants in smallsat deployments. How? Let’s get into it.

But, fair warning, it’s about to get…numbery.

Smallsat Activities of the Past 2.5 Years

Launch companies have deployed over 5,650 spacecraft into orbit for the past two and a half years. Of those, over 5,300 were in the mass class of smallsats (600 kg or less). Most of those smallsats were Starlink (3,630+) and OneWeb (520+). Subtracting their satellites leaves ~1,070 smallsats deployed in orbit from the beginning of 2021 through early June 2023, nearly 20% of all smallsat deployments.

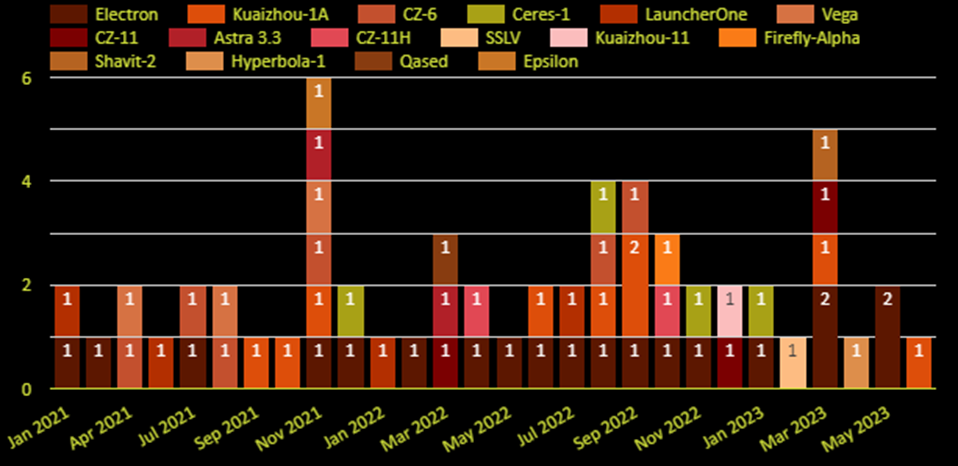

Seventeen operational “dedicated” smallsat launch rockets took part in launching those 1,070+ smallsats to orbit during that time. Eight of those rockets were from China, four were from the United States (although two of those four are no longer launching rockets), and then one each from Japan, Europe, India, Israel, and Iran. In total, they conducted 61 launches during the last 2.5 years.

Of those seventeen, Rocket Lab’s Electron has been the busiest, deploying over 60 smallsats since the beginning of 2021. The CZ-6 (from China) launched the second-highest number of smallsats, deploying 35. Third was LauncherOne, with 30. The sum of their deployments, ~125, is nearly 12% of the 1,070+ smallsats deployed. The remaining dedicated smallsat launchers have deployed 22 or fewer satellites since the beginning of 2021.

The most capable rocket of those three is the CZ-6, which can lift slightly over 1,000 kilograms to orbit. LauncherOne (which is no longer operational) could lift 500 kg and the Electron can lift up to 300 kg. Overall, the CZ-6 is estimated to have deployed almost 3,250 kg in orbit, launching five times to do so. LauncherOne launched four times, deploying an estimated total of 145 kg to orbit. The Electron straddles the middle, launching 17 times to deploy an estimated 2,040 kg.

The price to launch with the Electron is ~$7.5 million. If that price is consistent for each launch, then those 17 launches add up to $127.5 million for Rocket Lab, resulting in an estimated $62,500 per kg (which is expensive). Launching with LauncherOne supposedly cost about $12 million, potentially totaling $48 million for the rocket’s four launches. If true, then dividing that number by 145 kg makes it one of the most expensive ways to launch at ~$331,000 per kg.

Of the three rockets, the CZ-6 is launching an average mass of 650 kg per launch, while LauncherOne averaged a little over an estimated 36 kg per launch. The Electron launched 17 times, averaging nearly 121 kg of payload to orbit per launch. Their launch frequency and their competitors are in the chart below. It covers launch successes only.

Since this thought train began with European smallsat launchers, the Vega launched three times during the last two and a half years, averaging over 1,000 kilograms per launch and deploying 12 smallsats. While Vega has had reliability challenges, Arianespace doesn’t seem to use it, or its more capable Vega-C, often. If this is the case, are there enough European smallsat customers to help the European launch industry?

Leveraging Larger Launch

There are, but they tend to go a cheaper route: SpaceX’s Smallsat Rideshare program. In the first two SpaceX rideshare (Transporter) launches, companies from 13 European nations used SpaceX’s Falcon 9 to get their satellites in orbit inexpensively ($5,000 per kilogram at the time). That’s more European nations in two SpaceX launches than total satellites deployed from the Vega in the last two and a half years.

Those SpaceX rideshare launches add up, too. The very first Falcon 9 smallsat rideshare launch deployed 143 satellites. That single launch deployed more smallsats in one day than the top three smallsat rockets deployed over 2.5 years. Seven more Falcon 9 smallsat rideshare launches, when added to the first rideshare launch, account for more than 600 smallsats since January 2021–over half the 1,070+ smallsats not belonging to Starlink or OneWeb.

Other companies have also offered rideshare opportunities on their rockets, such as the Soyuz. At least two Soyuz rockets have deployed a combined fifty-five smallsats during that time. China’s CZ-2D (~60), CZ-2C (~40), and CZ-4D (~40) routinely deploy smallsats.

They cost less to use. A customer using SpaceX’s Smallsat Rideshare program can count on paying $5,500 per kilogram. The Soyuz might have been as inexpensive but isn’t politically available to many European customers. China’s offerings, however, may have some appeal (although there might be other tradeoffs). Even India’s Smallsat Launch Vehicle (SSLV)–a dedicated smallsat rocket, costs less than Electron or Vega, at about $9,000 per kilogram.

Note that these rockets–the Falcon 9, Soyuz, CZ’s, and at least four other larger rocket systems offer smallsat rideshare services. Some launch more often than Rocket Lab does its Electron, are less expensive and are reliable. Customers from many nations appear to be taking advantage of those characteristics.

Based on the numbers, it would make more sense to develop rockets that can launch thousands of kilograms at a time and easily accommodate smallsat and large satellite deployments. There’s a flexibility to those systems that dedicated smallsat rockets can’t match. It would be easy to point at the Falcon 9’s reusability as a critical way to compete, but then the other rockets–the PSLV, CZ’s, Soyuz, and others–have attracted smallsat operators, too.

Not a Boost, but Maybe a Small Pick-up

To be clear, there is a market for dedicated smallsat launchers. After all, the Electron and other dedicated smallsat launchers attract customers and launch frequently (61 launches aren’t shabby). However, it’s also clear that dedicated smallsat launchers can’t compensate for inherent performance limitations compared to more capable competitors offering smallsat rideshare services. That epiphany is a reason SpaceX jumped from Falcon 1 to Falcon 9. It’s a reason Rocket Lab is developing Neutron.

Are European dedicated smallsat launch companies key to boosting Europe’s launch sector while addressing serious launch capability concerns? Based on the recent history of smallsat launches and deployments, no. Even when smallsat companies launch more often, they don’t launch as much as a single rideshare launch does. They also can’t launch satellites with masses of thousands of kilograms (which are still used).

And they tend to be more expensive than the ridesharing competition. Their answer to that is that they can launch smallsat rockets into orbits tailored for their customers, instead of forcing them to compromise their optimal orbit for low cost. However, based on the numbers, startups find the rideshare competition’s pricing more compelling.

Even when viewed as steps towards developing larger rockets (such as the Miura 5), the plans don’t appear aggressive enough and certainly don’t guarantee the companies’ survival (two of the four U.S. smallsat launch companies have all but disappeared). On the other hand, Rocket Lab and others have demonstrated there is a market for dedicated smallsat launch–it’s just not as big as the smallsat rideshare market from the larger competitors.

Offering more smallsat launchers with high per-kilogram pricing doesn’t guarantee that the market will grow. Still, the ISRO’s SSLV launch pricing may prove attractive to smallsat operators that easily dismissed LauncherOne’s ludicrous pricing. Orbex and PLD Space can learn from the SSLV’s example, as well as Arianespace’s market mistakes, and provide competitive services at competitive prices.

Both might attract a few customers.

Comments ()