Mass, Frequency, Reliability: Comparing 2022 China and U.S. Launches

Launch Record

For those interested, the number of launch attempts globally hit 153 during the first week of November 2022. That, I believe, is called an “all-time high.” There were 146 launch attempts during 2021, and with over a month-and-a-half to go, 2022 launch activity surpasses that number and will stomp all over it.

To date, U.S. launch providers, primarily in the form of SpaceX, have launched the majority of launch attempts: 74. SpaceX is responsible for 51 of those launches (a record year for the company). While Rocket Lab’s launches are nowhere close to SpaceX’s–9–the company still took second place in the U.S. launch services (it’s also a record year for Rocket Lab).

Chinese launch attempts are nothing to sneeze at, either: 48. That year-to-date total is eight launches shy of the 56 that China’s space launch providers attempted in 2021. Russian and space launch providers from other nations make up the remaining 31 launch attempts for 2022 so far.

2022 looks to be the busiest launch year yet.

Mistake: Relying on Launch Counts Only

Noting that probability, perhaps it’s time to look a little deeper at the launch activities of companies in the U.S. and China so far. Much has been made about the number of launches conducted within those nations. I’ve also done this but always attempted to add more data and context to these launch activities. However, the number of launches is the easiest data set to get, but relying only on that data yields an incomplete and possibly untrue story. Moreover, not all launches are the same, yet some people will lump them together. That’s a mistake.

Caution: Before going further, be aware that the rest of this analysis gets a bit…mathy.(?) It involves numbers and percentages, and while I’m trying to keep things clear, I might still succeed in confusing readers. I apologize in advance. Also, I’m not a math guy.

Launch vehicles and their capabilities can provide insight into a nation’s ability to compete in space. Without getting into the weeds, a few of the fundamental launch capability characteristics useful to me in gaining those insights are:

- Upmass ability

- Launch frequency

- Vehicle reliability

It’s not a comprehensive list, but it is useful. Other characteristics, such as the overall payload value or who owns what particular satellite, orbital altitudes, etc., could be thrown in. But to keep things simple while trying to maintain interest and relevance for this analysis, I’ll stick with those three characteristics. So while the following isn’t an apples-to-apples comparison using that list, it is interesting to do the math of each nation’s most-used rocket during 2022.

Apples and Oranges=Long March and Falcon

For example, China’s 2022 launch rate looks high. However, one of the most used rockets for the year was the CZ-4C, which has been launched seven times so far. (Ugh! I just went over the history again and found the CZ-2D was THE most used rocket in 2022. It launched twelve times so far. It carries much less to orbit—1,300 kg—so my argument still stands.) That’s less than one launch per month for that particular rocket, indicating a relatively sedate, almost ULA-like, turnaround time. There’s also a reason why the CZ-4C is launched so often–its upmass capacity of 3,200 kilograms to low Earth orbit (LEO) is modest. It is a reliable launch vehicle.

Comparing the CZ-4B with the most-used rocket in the U.S. in 2022: the Falcon 9. That rocket has launched 50 times so far. That’s four to five Falcon 9 launches per month (which is unheard of). Its upmass capacity is 22,800 kilograms to LEO. The latest iteration of the Falcon 9 is the most reliable rocket on the planet, especially considering it's gone through 50 launches this year without any inadvertent fireworks.

It would take over seven CZ-4C launches to deploy the mass equivalent of a single Falcon 9 rocket. And, if the CZ-4C’s launch rate is unchanged, it would take nine months (the last time one was launched was in September) to deploy that mass. It gets wild, though, if we use the same time span (9 months, from January through September) to calculate Falcon 9 activities. Forty-three Falcon 9s launched during that time, with the majority lifting Starlink satellites to LEO, roughly averaging 13,000 kg upmass per launch (4X the CZ-4B capacity). The total mass deployed from the Falcon 9, largely in Starlink form, would be ~560,000 kg. If SpaceX used it to full capacity for each launch, it would have deployed ~980,000 kg.

To insert some realism into this conversation, it’s worth noting that no rocket launch company launches a rocket using its total upmass capacity. Engineers like a little wiggle room, fairings and connectors may limit space, etc.

Even if the comparison were more apples to apples–between the Falcon 9 and the CZ-5–the F9’s launch frequency of 50 (January through the 1st week of November) makes the CZ-5’s two launches look unambitious. Those two CZ5 launches could potentially lift a total of 50,000 kg to LEO. The CZ-5 is also not as reliable as one of its total nine launches failed.

Launching Often To Make Up For Compromises

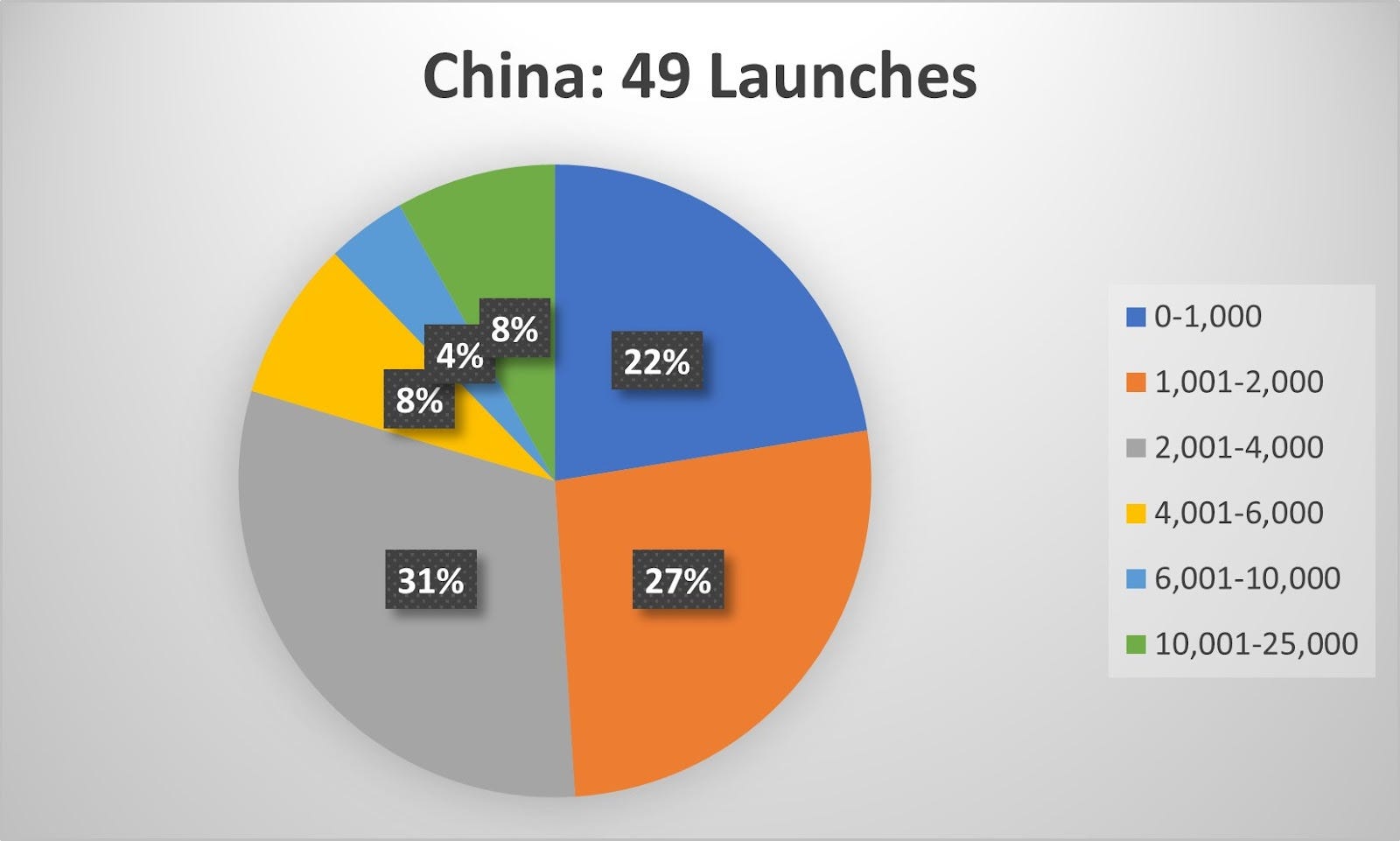

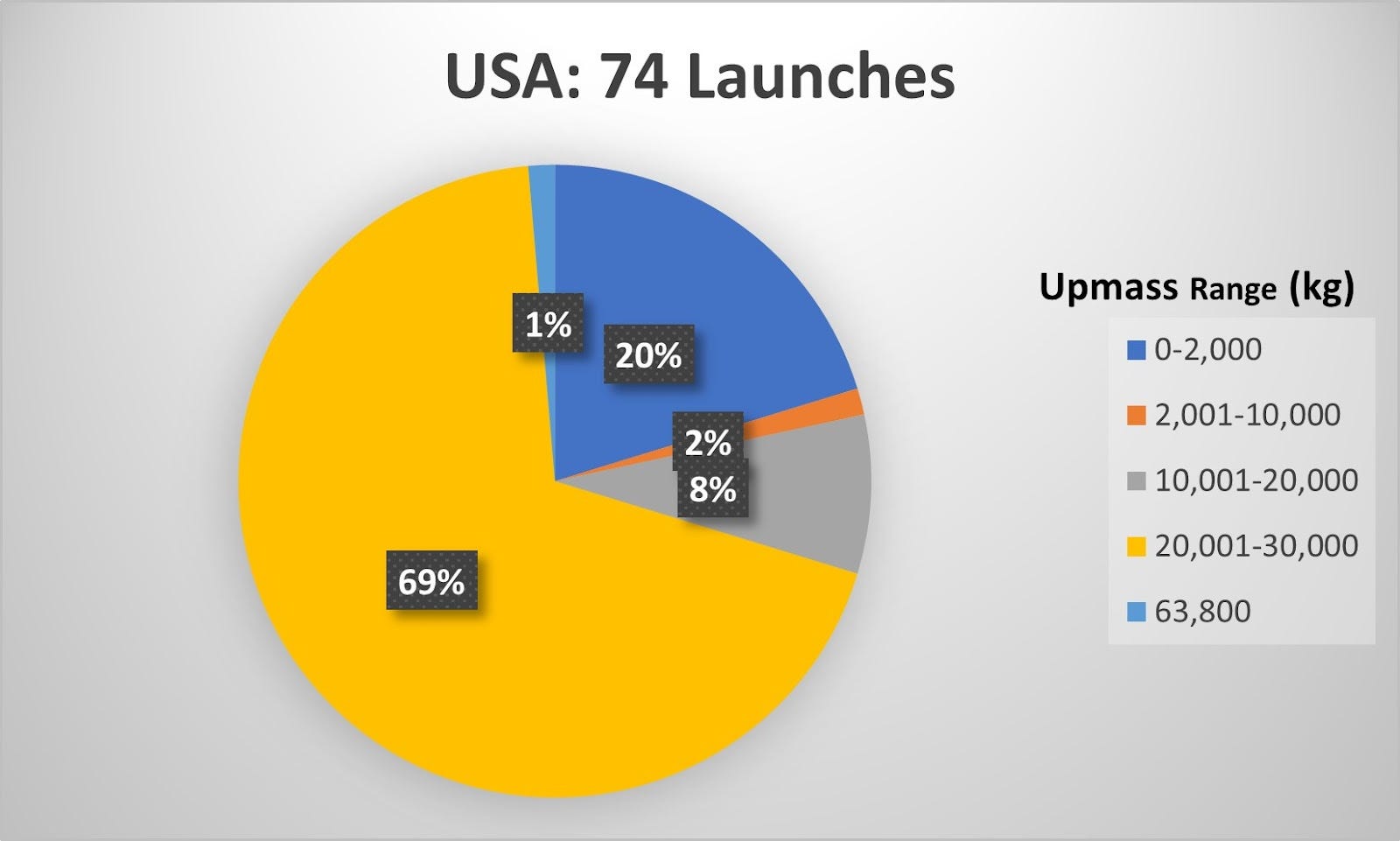

Some interesting trends show up when looking at the differences in upmass capability among the rockets launched from China and the U.S. in 2022. So far, Chinese launch companies have attempted launching 16 types of rockets (vs. 14 from U.S. companies). 44% of the rocket types launched from China have an upmass capability of less than 2,000 kg. (including newly developed rockets). On the other hand, 36% of U.S. rocket types launched during the same period fit in that same category.

The upmass capabilities of the rockets from each nation show differing upmass ranges. For example, 88% of the 16 rocket types launched from China are incapable of lifting over 10,000 kg of payload mass to LEO. Of the 14 U.S. rocket types, 57% can lift more than 10,000 kg.

The upshot, then, is that while China’s companies are often launching, ~70% of the vehicle types launched have little to modest upmass capability (less than 4,000 kg). In contrast, nearly 60% of U.S. launch vehicle types can lift more than 10,000 kg to orbit, with SpaceX boosting overall launch frequency. The additional upmass capability is crucial because it provides flexibility in the compromises made for spacecraft design and ability. Rocket upmass limitations impact space missions. In “Compromised Capabilities: Smallsats As Tools, Not Cornerstones,” I noted:

“For smallsats, nearly everything considered is a compromise. Worse, they are typically compromises of compromises already established for larger satellites. Whatever can be done to minimize mass and cost is done for smallsats. It’s the primary reason why commercial smallsat manufacturers and operators embrace miniaturization.”

Yes, miniaturized electronics, components, etc., have made small satellites capable and useful. But those capabilities are inherently compromised. A launch vehicle with large upmass capability doesn’t eliminate all compromises, but it provides spacecraft designers more headroom to ensure a spacecraft’s mission can be accomplished. If a company or military has access to several launch vehicles with large upmass capability, that provides some schedule reliability for spacecraft deployment (as well as the ability to launch more mass into space during a given period).

As noted earlier, while China’s companies may often be launching, they do so because they don’t have an alternative with an equivalent launch frequency. As depicted in the chart below, not only are they launching more often, but 80% of the launches in 2022 so far require compromises in satellite designs because of upmass limitations. Only two rocket types launched from China in 2022 could deploy a spacecraft, such as the Hubble Space Telescope (11,110 kg) in LEO. They launch infrequently, but that could change. The fact that China’s companies had no “heavy-equivalent” rockets to do so before 2017 may indicate a ~13-year lag behind U.S. launch capabilities. If we consider the Saturn V or Space Shuttle as heavy-lift (instead of just using ULA’s Delta IV Heavy), then that could be translated to a decades-long lag.

Meanwhile, 80% (below) of the rockets launched by U.S. companies in 2022 (thus far) would have been able to deploy another Hubble (at least on paper). However, that will change and depend on whether plans for new large-capacity U.S. rockets emerge into reality next year. ULA is using up its Atlas 5 and Delta IV Heavy rockets, intending to introduce Vulcan (27,200 kg) in their stead. Blue Origin might also launch its New Glenn (45,000 kg) in 2023. Each brings significant upmass capability. Whether they’ll be able to launch those new rockets as frequently and reliably as SpaceX does with its Falcon 9 remains to be seen. It took SpaceX 7-8 years to finally launch ten or more Falcon 9’s in a year and about five more years after that to achieve its current rate.

Their launches, however, are in the (hopefully) near future. If either or both launch, they’ll be counted toward U.S. launch totals. If they don’t, the U.S. relies on a single launch provider for its capability, which is a step backward. Worse, that launch provider is run by someone who displays monopolistic behaviors in his other endeavors, such as Starlink and Twitter. Whether he would fully bring those behaviors to SpaceX would likely depend on Blue Origin’s and ULA’s potential as competitors.

If they can field their rockets, both companies will bring more capability to the global launch industry than currently available and help keep those monopolistic tendencies in check. Focusing on counting rocket launches and not providing context would perhaps have missed that issue–monopolizing rocket launch–and the capabilities Blue Origin and ULA might bring to the sector next year as competition.

Comments ()