Seeing Infrared, Part 3: What Does Nearly $3 Billion Buy?

This is the third part of a series analyzing the “value” of the Space and Missile System Center’s (SMC’s) infrared satellite contract with Lockheed Martin. This part of the analysis provides why:

- NGOPIR satellites don’t respond to current DoD concerns

- NGOPIR satellites’ capability and technology will be evolutionary from that of SBIRS

- NGOPIR satellites will need a new ground system

Here’s Part 1 and Part 2. On to Part 3...

Missing Parts=Missing Opportunities

My capabilities list in Part 2 is what SBIRS is already doing based on the USSF’s description. I assume that NGOPIR will duplicate much of SBIRS’ capabilities, with some upgrades. Note that the NGOPIR upgrades do nothing to address the USAF/USSF’s concerns regarding retaining space capabilities (for many years). From the “Chief of Space Operations’ Planning Guidance,” (page 6):

“Recent resurgence in deployment of modern direct assent [sic] and co-orbital ASAT capabilities require us to develop and deliver offensive and defensive options in the near-term, while we transition to a resilient architecture able to mitigate attack, assure capabilities, and rapidly reconstitute in the mid- to long-term.”

SMC is not paying attention to that planning guidance--just as it didn’t pay attention to Hyten’s worries. Odd, for an organization that makes up more than half of the USSF’s personnel. Capabilities that the NGOPIR satellites should have to address USSF concerns, but don’t, are:

- Armor

- Defense (nets/chaff)

- Agility

- SSA/SDA capability

- Stealth

Even just one of those capabilities would be helpful (and possibly justify the current cost). While those aspects add to a satellite’s mass, it would be relevant to understand that a SBIRS satellite mass is around 2,500 kg--small compared with some of the communications satellites launched into GEO. The GEO capabilities of SpaceX’s Falcon 9 (8.3 tons) and Falcon Heavy (26.7 tons) appear to make additional mass somewhat moot. The relatively low launch costs of those two launch systems should make them even more appealing. But SMC seems comfortable pushing “the same, but better” satellites from the same contractor.

Evolution=Efficiencies?

The current SBIRS constellation consists of four dedicated satellites in GEO and two more infrared sensor packages on classified satellites in highly elliptical orbits (HEO). The GEO satellites use Lockheed’s A2100 bus as the structure containing all the power, attitude control, communications (commanding and data), and computing to support two types of infrared sensors. A Lockheed press release provided the reasoning for selecting an updated bus for the last few SBIRS satellites:

- Drives efficiency and cost savings into satellite design and production by leveraging common components, processes and production practices across the entire satellite production line.

- Features 26 improvements that add more power and flexibility to the company’s proven A2100 satellite platform.

- Increases satellite resiliency, eliminates older components and utilizes modern electronics to add new capability and increase reliability.

- Offers a configurable payload module that provides more flexibility for military missions, accommodating mass, power, propellant and volume.

- Allows easy implementation of additional modernized sensor suites and mission payloads thru its modular design.

Those reasons sound very--programmatic. If $1.4 billion (down from $1.7 billion) results from leveraging and gaining efficiencies, then perhaps it’s time for SMC to re-evaluate what reasonable costs are. It’s evident with the contract awarded for NGOPIR that despite public acknowledgment of issues and lessons to be learned from SBIRS (and other programs), SMC is sitting in the classroom corner with a pointy cap on its head.

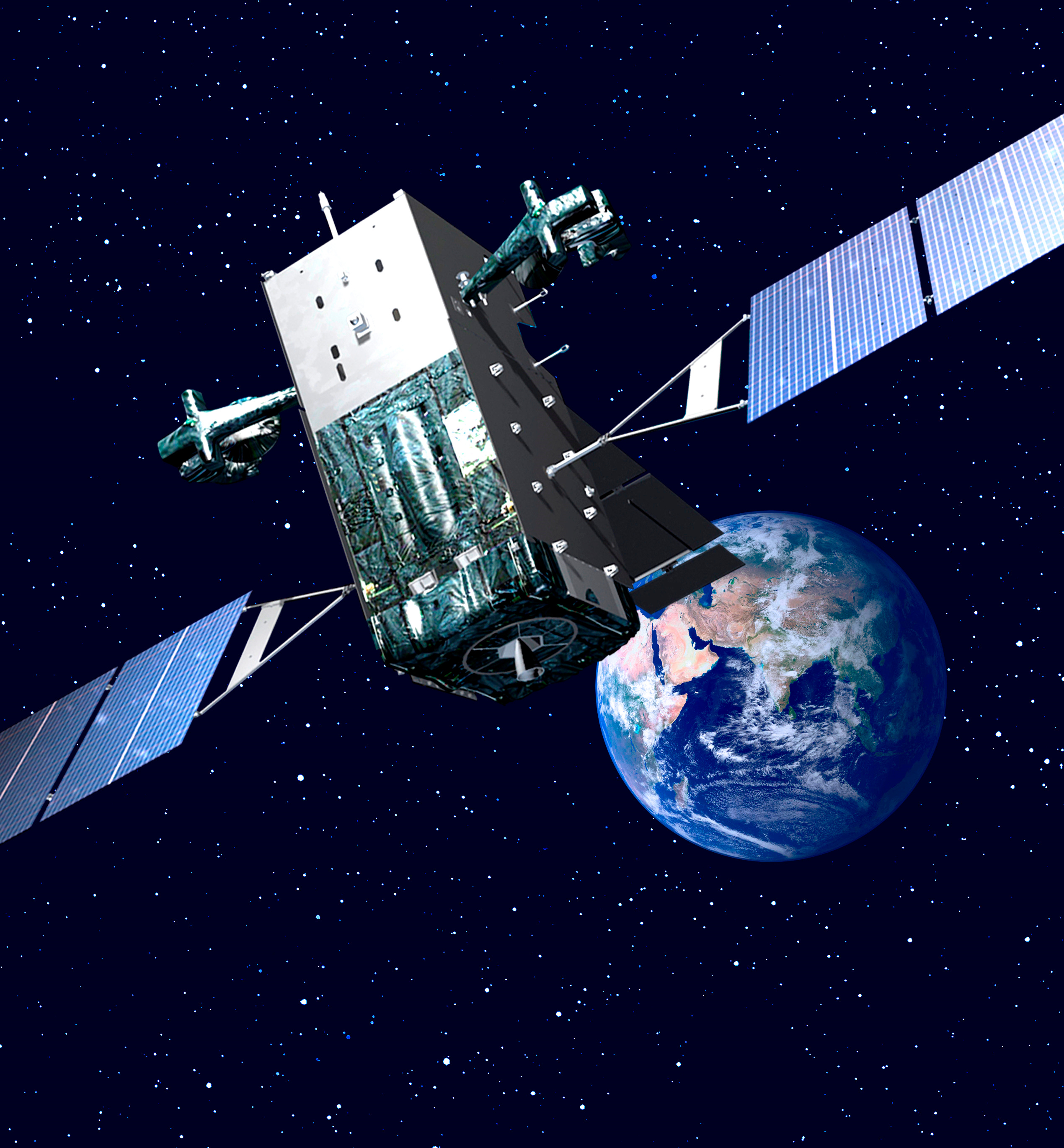

Image from afspc.af.mil

Lockheed’s SBIRS satellites are on the smaller side, with a mass of 2,506 kg. The two sensor payloads add up to ~500 kg (included in the overall satellite mass). While 500 kg may appear quite large, part of that mass probably contributes to some sort of heat control/dissipation (infrared sensors like cooler environments) and sensor protection, such as a sun-shade (which appears to be poking out from behind the satellite in the image above).

The Space Force page notes the spacecraft are “militarized,” which is nearly meaningless unless referring to camouflage paint. However, the Space Force also describes the satellites as “radiation-hardened,” referring to their electronic components’ ability to remain operational after nuclear explosion effects. Aside from the two descriptors above and the sensors, there is not much else with SBIRS that deviates from Lockheed’s commercial A2100 offerings (typically communications satellites). Except for the SBIRS satellite cost--which is at least 183% more than commercial communications satellites.

Lockheed is following nearly the same recipe for the NGOPIR satellites that it used for SBIRS. Lockheed is using a modernized LM2100 bus as the foundation for the NGOPIR birds. Again, NGOPIR’s missions will likely not deviate much from what SBIRS already does. Mission similarities imply that NGOPIR satellites will mostly have the same, but upgraded, capabilities when compared with SBIRS. Nowhere in the NGOPIR announcement were there any new capabilities to address USSF’s concerns.

Ground Control to Major Wrong

The NGOPIR contract announcement did not appear to include the ground system hardware to operate them and receive data--only the software. New communications payloads, large data streams, and low latency requirements all add up to ground system hardware the USSF doesn’t have with SBIRS, a program initiated in the late 1990s. NGOPIR satellites would require the USSF to install new equipment on the ground. This equipment would likely be in the form of exquisitely-priced “optional-extras” from Lockheed. An afterthought.

New equipment and what will optimistically be called a lackluster vendor-supplied user interface (are they ever really good?) requires new operations processes. New hardware and software require more crew training, which already includes two legacy satellite systems (DSP and SBIRS) and their command hardware/software. Again, this is in-line with SMC’s history of treating ground systems (such as SBIRS and, more recently, GPS-OCX) as an afterthought, demonstrating its lack of very basic pattern-recognition present in most humans.

Also, ground systems tend to be very expensive--especially when done the DoD and Lockheed way. As it did with SBIRS, Lockheed appears to be ready to lock in NGOPIR’s communications network and data. This article notes that AT LEAST two other networks, SMC’s Future Operationally Resilient Ground Evolution (FORGE) and the Space Development Agency’s (SDA’s) missile tracking layer, will be implemented for OPIR missions. Seeing Raytheon’s successful history of running GPS-OCX (this is sarcasm), SMC selected Raytheon for FORGE.

The variety of networks implies that not only will Lockheed need to build the NGOPIR ground system--it then needs to figure out a way to have that system--both hardware and software--reliably interact with other homebuilt OPIR networks and data. All of this will require more money than the $2.7 billion per satellite costs SMC is currently paying. And this cost does not include the polar part of the NGOPIR constellation--two satellites from Northrop Grumman for $2.375 billion, nor the ground system associated with them.

Last October, I wrote up the analysis “The Beginning of the End (of Expensive Satellites)?” In it, I noted that companies like OneWeb and SpaceX are making inroads with their fast and high-capacity satellite manufacturing:

“…SpaceX gets a toe in the door of satellite defense contracting, beyond which is a room filled with companies who bill high, aren’t competitive, don’t like change, and move very slowly. They’ve seen SpaceX’s impact on launch companies that exhibited the same traits: expensive, non-competitive, and slow. Legacy defense satellite manufacturers should be concerned.”

As we see, legacy defense satellite manufacturers are still billing high, are not changing (at least with DoD contracts), and are still moving slowly. But they are being encouraged to do so when SMC keeps rewarding them with large contracts.

In the end, the DoD and SMC appear to be on auto-pilot, not addressing national security space needs. The latest contract shows that:

- NGOPIR satellites are too expensive (by about 200%)

- The NGOPIR satellites will remain tempting targets

- The missions for NGOPIR satellites will not deviate much from SBIRS current mission

- NGOPIR satellites will be employed similarly to SBIRS

- NGOPIR satellites don’t respond to current DoD concerns

- NGOPIR satellites’ capability and technology will be evolutionary from that of SBIRS

- NGOPIR satellites will need a new ground system

Simultaneously, the overall development and manufacturing costs for the NGOPIR satellites are significantly higher than SBIRS’--which were already relatively high (in spite of “efficiencies gained”). Are those upgrades worth an additional $1.3 billion per satellite? Are the capabilities worth nearly $3 billion each?

I’m sure Lockheed’s shareholders believe so. SMC certainly does.

(As a reminder, I am attending classes now. The timing of postings over the next few months may be erratic. Since I am in a “Commercial Space” program, I may also write about what I’ve learned/observed from it as I go along. We will see.)

Comments ()