ULA and Launch Industry Structure Changes

Markets and Marketing

ULA’s CEO, Tory Bruno, sometimes offers his two cents about the launch market. And by launch market, he really means the small slice of launch activity his company conducts for the National Security Space Launch (NSSL) program (and performed for the Evolved Expendable Launch Vehicle (EELV) program before NSSL). In a SpaceNews interview, Bruno offered his perspective again just this last week, specifically about changes adding a possible third competitor to NSSL (and, therefore, possibly cutting into launches available for ULA rockets).

When I’ve seen stories where Bruno talks about military launch contracts, markets, and competition, I’ve written a couple of analyses responding to his ideas. The upshot of my responses: NSSL isn’t a market, and until SpaceX came along, ULA had no competition. ULA was going to launch rockets for the DoD no matter what because until SpaceX, there was no one else. It still gets the largest share of DoD launches in return for more cash than its competitor, SpaceX.

To be very clear, I respect Tory Bruno. He took over ULA’s reigns during difficult times and is doing what he can to keep the company running. I haven’t seen him say anything negative about anyone in public, and he appears to be a genuinely pleasant fellow to know.

But his ideas about launch markets and competition are a bit out of touch, and I’m going to explore a little bit here about why I think that is. My assumptions could be totally incorrect, but launch data seems to back them up. I will also refer to my favorite business guru’s writings, Peter Drucker. A few sections of his book, “Innovation and Entrepreneurship,” fit some of the things happening in the launch industry.

The Future Now

Specifically, ULA’s responses to launch industry changes fit at least one of Drucker’s textbook definitions of an innovation source. He defines innovation as creating a resource. Successful innovations exploit change. ULA’s responses have, ironically, created an innovation source for competitors to exploit. A particular competitor has exploited that innovation source.

In Bruno’s latest interview, SpaceNews quoted him saying:

The global launch market will experience “real scarcity,” Bruno said. “It is becoming tighter” as commercial players like Amazon buy up the available rockets.

That is a slightly different tune from what he sang during a separate interview just two years ago. During that interview, Bruno noted that the launch market had a few problems. They were:

Problem: Overheated launch “market.”

Too many launch companies

Too many new launch vehicles

Too much investment in risky launch businesses

No launch market growth

Falling launch prices

Static satellite demand

At the time, I noted:

The snarky interpretation of Bruno’s contention: Vulcan (and therefore, ULA) can only compete in a market without falling launch prices, few competitors, and U.S. government interference.

Even with few competitors, ULA’s annual launch cadence has not grown but declined instead. The launch competitor situation two years ago was that only one was operational (which hasn’t changed), taking on ULA in the fight for U.S. military launch contracts: SpaceX. Maybe Bruno was referencing all the planned launch vehicles, such as Blue Origin’s New Glenn, but none of those planned rockets have yet to launch into orbit.

As for “risky” launch businesses, he wasn’t far off–it’s just that those risky businesses weren’t offering rockets that would compete with his company’s offerings. Virgin Orbit eventually went bankrupt, and Astra seems to be at the game stage where “Finish Him!” has just been announced.

But Bruno’s second assertion of an overheated launch market was flat-out wrong. Satellite demand has increased–excluding Starlink–and ULA’s single competitor is the only one offering “falling” launch prices (primarily to commercial customers). Neither ULA nor Arianespace has offered meaningful launch price reductions encouraging smaller commercial customers to use their rockets, even when referencing their planned ones.

Inadvertent Innovation Source: Launch Industry Structure Changes

Unfortunately for Bruno, his perspectives seem to be right in line with Drucker’s description of how industry insiders (legacy space companies) perceive changes in industry structure and the outsiders who take advantage of those changes: as threats.

What are those industry structure changes? Drucker provides four indicators:

- Rapid industry growth

- Doubling in market volume=old industry rules and knowledge don’t apply

- Convergence of technologies that seem separate

- Business practices change rapidly

Drucker uses automobile and telephone industries as examples for bullet 1. In his book, he states:

If an industry grows significantly faster than economy or population, it can be predicted with high probability that its structure will change drastically—at the very latest by the time it has doubled in volume. Existing practices are still highly successful, so nobody is inclined to tamper with them. Yet they are becoming obsolete.

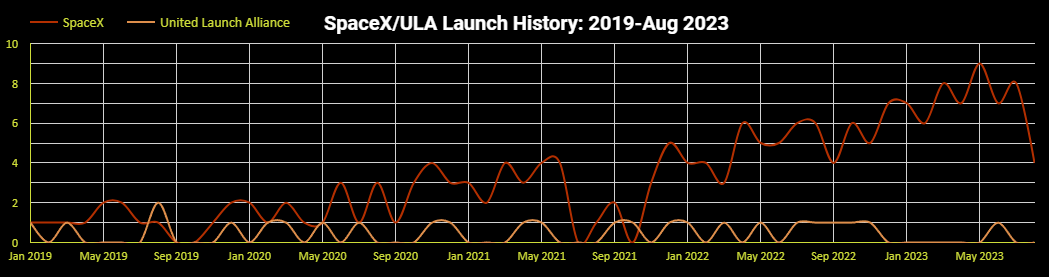

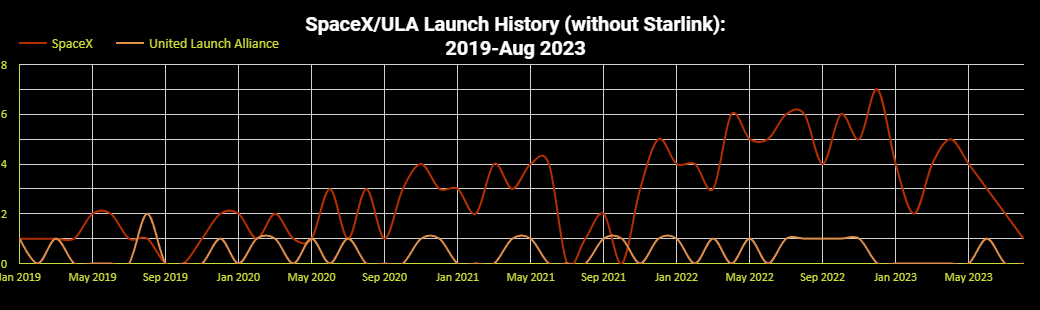

That sounds remarkably familiar. At least activity-wise, the industry has been rapidly growing, as seen in the chart below (all due to one company). And yet the legacy company is adhering to existing practices, not risking tampering with them.

Not only that, it’s doubling as well (bullet 2). SpaceX’s launch activities in the U.S. have effectively been more than double those of ULA’s launches each month since August 2020 (and not just with Starlink–see below).

That launch doubling indicates a change in the industry which in turn means that the hard-won industry knowledge legacy/insider companies fought for might be outdated. Drucker noted that:

…the ways in which the traditional leaders define and segment the market no longer reflect reality, they reflect history. Yet reports and figures still represent the traditional view of the market.

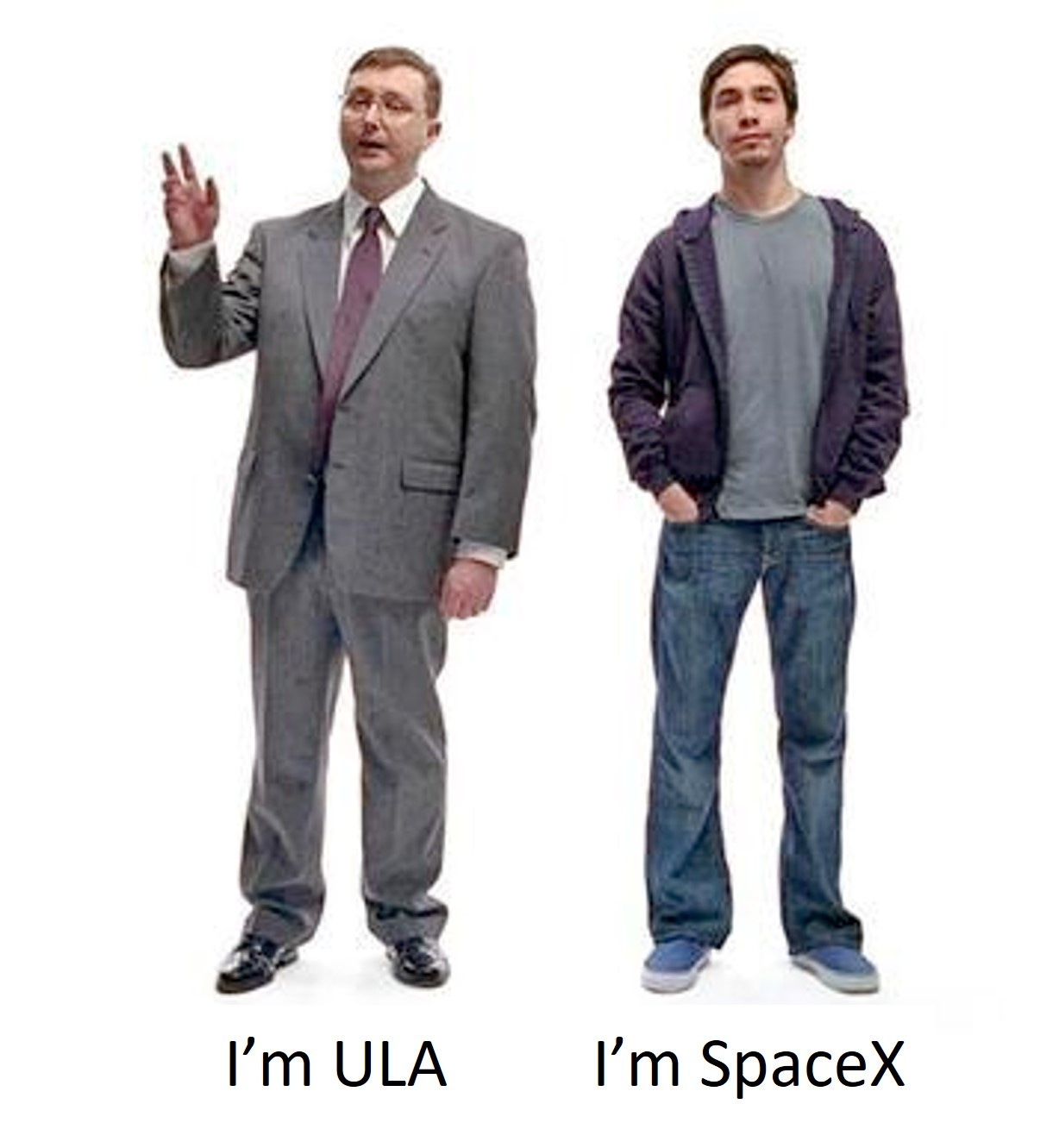

Notice that Bruno barely acknowledges the changes in the industry his company is fighting to survive in. His definitions for competition and launch market still reference a time before SpaceX’s launch dominance (some analyst companies are falling into this trap, too). It’s like Microsoft’s refusal to acknowledge Apple’s ascendancy during the “Hi, I’m a Mac!” ad campaigns. However, Microsoft eventually fought back and appears to be doing quite well.

For bullet 4, the business is changing rapidly. Drucker describes a reason for the change:

Innovations that exploit changes in industry structure are particularly effective if the industry and its markets are dominated by one very large manufacturer or supplier, or by a very few. Even if there is no true monopoly, these large, dominant producers and suppliers, having been successful and unchallenged for many years, tend to be arrogant. At first they dismiss the newcomer as insignificant and, indeed, amateurish. But even when the newcomer takes a larger and larger share of their business, they find it hard to mobilize themselves for counteraction.

It’s almost as if Drucker had witnessed the state of the U.S. launch industry today and then went back to 1985 to write his book. ULA appears to be having difficulty, no matter the cause, in mobilizing itself for counteraction. It’s not able to respond to SpaceX’s ability to launch frequently and reliably. It’s not clear whether ULA will be able to do so when Vulcan does come online.

Bullet 3 is the one indicator I’m having difficulty finding. The convergence of separate technologies is not apparent to me. I’m unsure if reusability melds distinct technologies, so perhaps it’s best to leave this one alone (or let readers suggest some possibilities).

First Step…

Despite my lack of imagination for bullet 3, the U.S. space launch industry, perhaps the global space launch industry, is undergoing an industry structure change. ULA’s responses (or lack thereof) are creating an exploitable innovation source in which a single “outsider” company can accelerate industry change. One company is doing just that.

While I applied Drucker’s words to this ULA examination, they could just as easily apply to Arianespace’s or the Russian space sector’s responses. That Tory Bruno is repeating much of what he said even three years ago about markets and competition fits Drucker’s description of how inside companies respond to industry structure changes–which isn’t positive.

ULA is adhering to its old business formula and moving at a pace that ignores industry changes. Both have impacted a large customer, Amazon Kuiper, negatively. Again, that indicates a reliance on old knowledge and practices–that the customer is willing and able to wait while still shelling out big bucks–vs. the reality that Kuiper represents. ULA is also missing out on Space Development Agency launches, which some might argue is the future of DoD space launch acquisitions.

Lowering customer expectations isn’t a great way to get repeat business; not seizing new opportunities just sends the wrong message to prospective customers. At the same time, ULA is providing at least one opportunity for competitors based on at least three of four indicators signifying industry structure changes. In short, ULA’s problem isn’t the number of competitors for a particular contract but ULA itself.

Comments ()