3Q21 Orbital Space Launch Review

Another quarter, another update of orbital launch activities and attempts from around the world. This review covers launch activities from July-Sept of 2021, and all of the launch data comes from Gunter’s Space Page. If you’d like to review the previous two quarters of orbital launch activities, please use this and this to access those reviews.

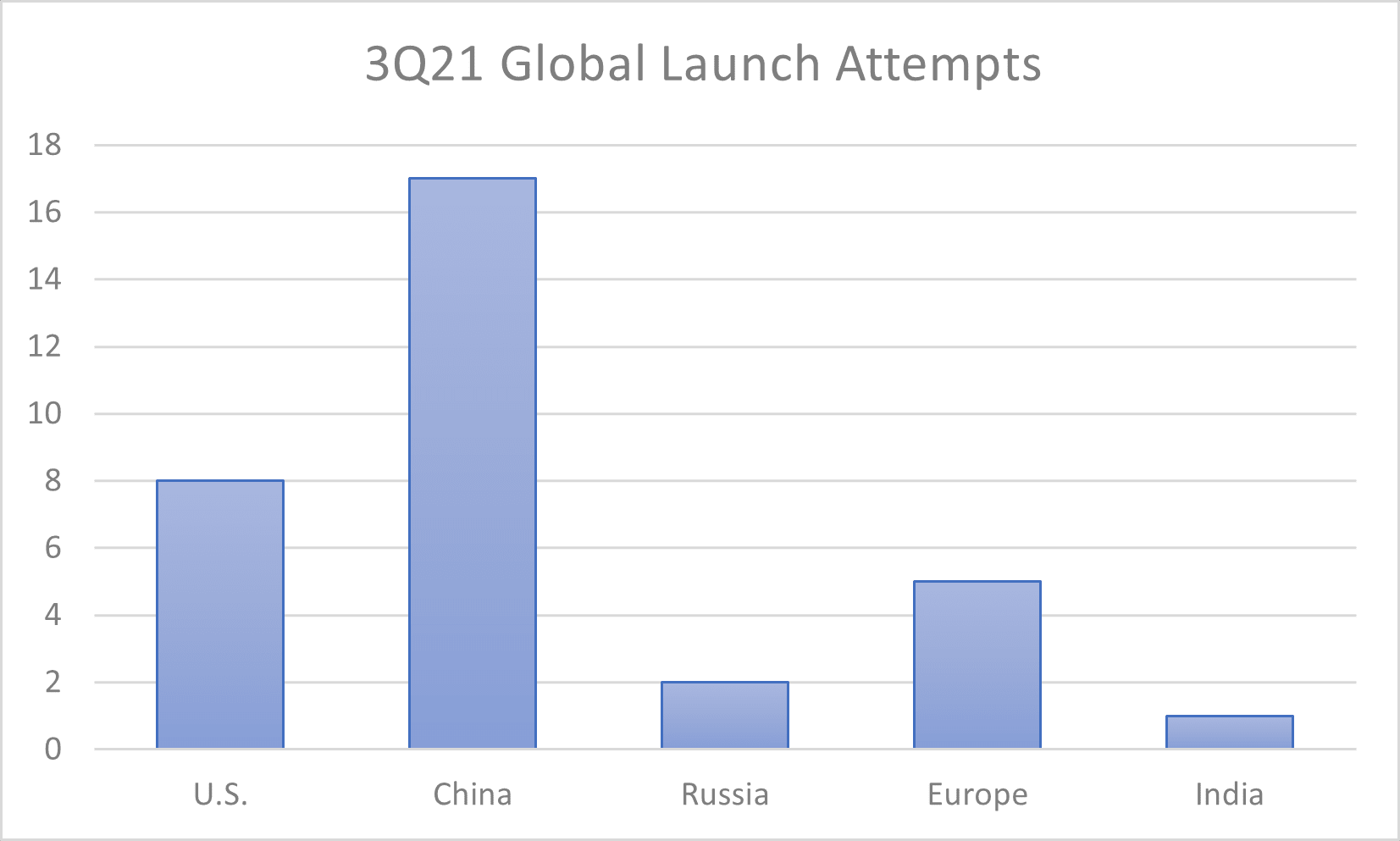

3Q21 Launch Attempts

During the third quarter of 2021, rocket launchers tried launching 33 orbital-capable rockets, just two launches shy of the previous quarter’s launch activities. Of those 33 launch attempts, four failed to achieve orbit. Two U.S. companies accounted for half of those failures, while one Chinese company and India’s space agency each had one failure.

The breakdown of rocket launches by country of origin for the third quarter is below:

The missing nation with an orbital launch capability is Japan. That nation hasn’t conducted any launches during 2021. India’s single launch attempt during 3Q21 failed (they were launching the Geosynchronous Satellite Launch Vehicle--GSLV).

As for the nations launching successfully, 60% of Europe’s five launches were the Arianespace-sponsored launches of the Soyuz in Russia. The other two European launches were one each of a Vega and an Ariane 5 out of Kourou in French Guiana. China’s launch service providers very obviously launched more than any other nation during 3Q21, with 17. U.S. launch providers managed to conduct eight launch attempts, although two of those were failures. U.S. launch attempts in 3Q21 were less than half of those conducted in 2Q21. Russia is keeping up an anemic pace of launch attempts, conducting only two during the third quarter.

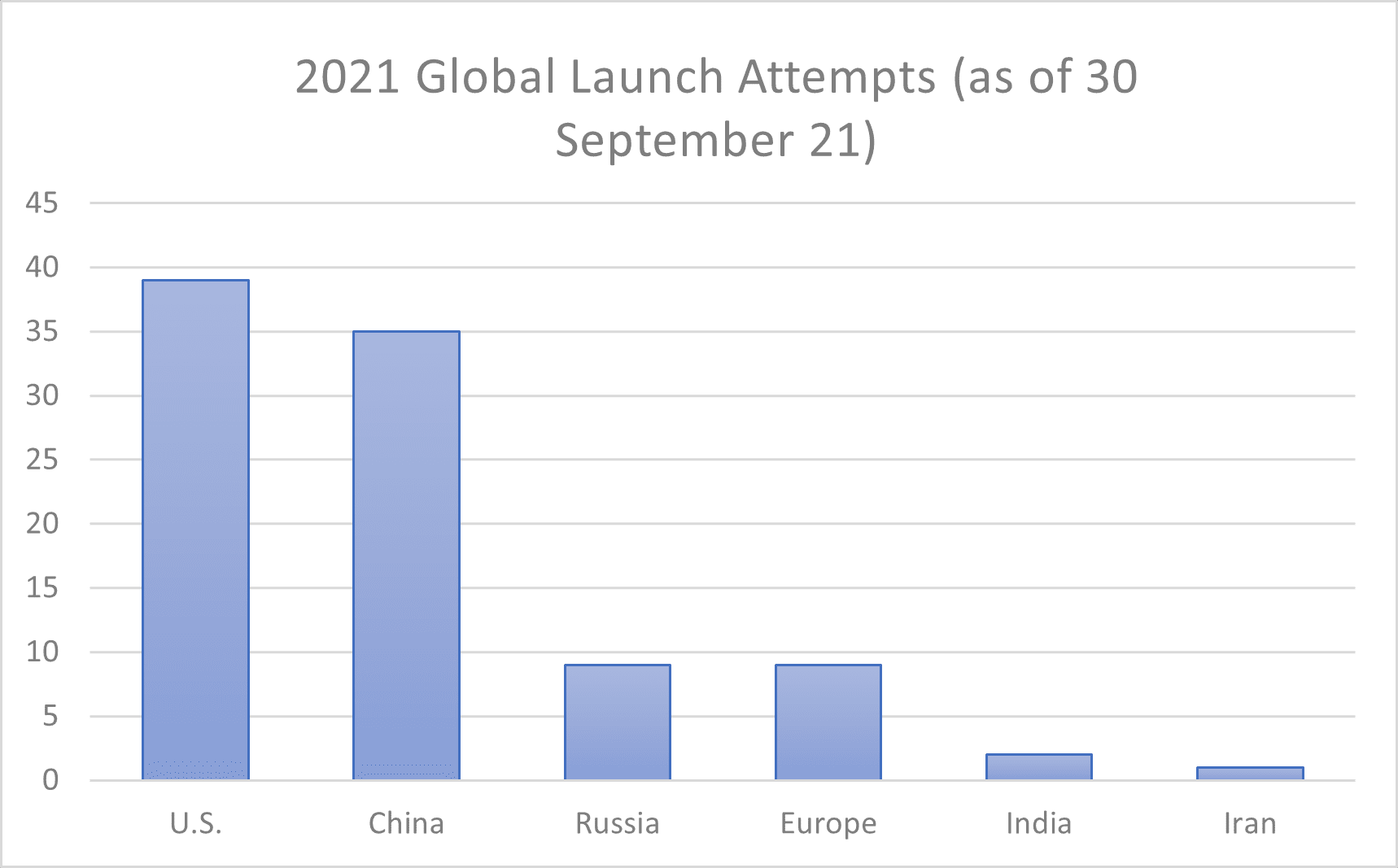

Total launch attempts of each nation from January through September 2021 are broken down below:

With a quarter to go in 2021, these nation’s launch providers have already conducted 95 launches, about 85% of 2020 total launch attempts (112). U.S. and China’s launch providers together took a nearly 78% share of all 2021 launches so far. Russian and European launch providers are neck and neck, with nine launches each. Although, the Europeans shouldn’t get too excited about that number since nearly 60% of their launches through a European provider/intermediary were conducted from Russia using the venerable Soyuz rocket.

U.S. launch service providers remain ahead of those in China, but the other nations aren’t even close to their totals. Europe is not surprising, as Arianespace usually conducts a lackadaisical-paced 11-12 launches per year and seems to be on track to stay close to that pace. But most European launches support the Russian space industry and not European interests through Arianespace’s continued use of the Soyuz rockets.

Without Arianespace’s contract with Russia’s Starsem and Roscosmos, the Russian launch industry would appear to be in the doldrums (a fact the Russian government appears to want no news reporting about). Instead, Russia’s launch activities seem to have decreased significantly except those launches conducted under Arianespace’s contracts. It’s fascinating to see Europe’s willingness to support Russian industry despite that nation’s anti-democratic activities. With three months remaining, Russia’s launch services may still reach a modest equivalent with its 2020 totals by 2021’s end. While it will take the third-highest spot, that total will be a far cry from its annual launch totals a decade ago.

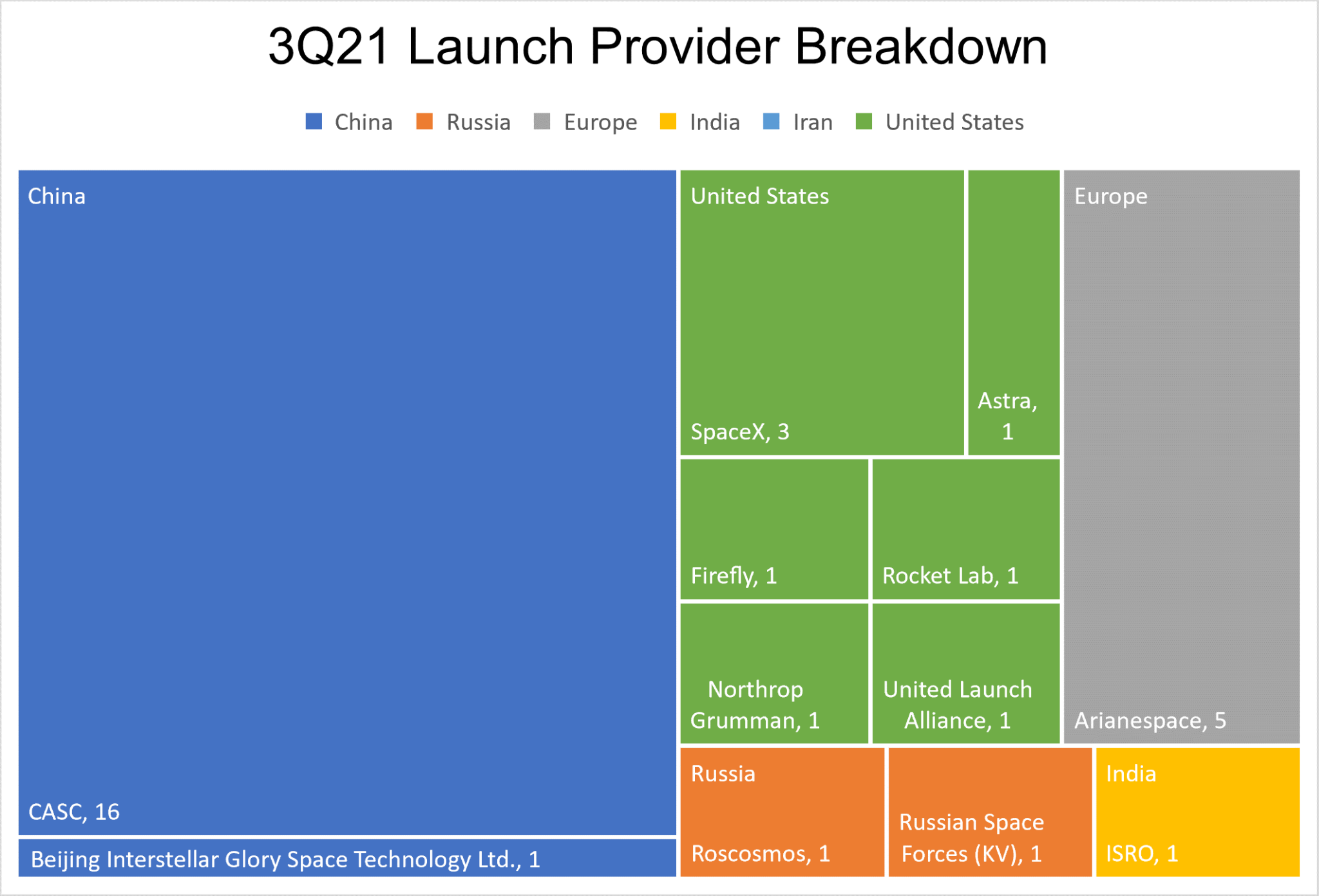

3Q21 Launch Providers

Breaking down the activities of each nation’s launch provider yields the box charts below:

It may be of interest to note that while China’s launch providers were more active during the quarter, the U.S. launch providers represent what appears to be a healthy diversity of launch companies. Other groups, such as Europe, and nations such as Russia, use a variety of rockets from different manufacturers. However, their activities go through a single launch service provider. These relationships are why we see Arianespace launching Russian-made Soyuz, the (primarily) Italian-made Vega, and the French Ariane 5, and why Russia’s Roscosmos launches rockets manufactured by Khrunichev or JSC SRC Progress (Samara Space).

China’s launch providers took the most significant number of launch attempts during 3Q21, with Beijing Interstellar’s launch of its Hyperbola-1 rocket the only failure of the 17 launches from that nation. However, the China Aerospace and Technology Corporation (CASC) and its subsidiaries continued dominating the launches of that nation, launching the usual combination of CZ (Chang Zheng=Long March) 2, 3, 4, 6, and 7 rockets.

U.S. launch companies attempted 8 launches during the third quarter. Three of the U.S. companies (Rocket Lab, Astra, and Firefly) are focused on smallsat-capable rockets, and of those three, only one (Rocket Lab) has successfully conducted launches--just not very reliably. During 3Q21 Astra and Firefly each attempted rocket launches which resulted in failures. The single Northrop Grumman launch was for a NASA International Space Station (ISS) cargo run using its Antares rocket. ULA launched an Atlas V rocket to deploy a Landsat satellite.

SpaceX conducted the most launches of all U.S. launch providers--3--during 3Q21. Considering how active SpaceX has been in the past few quarters, those three launches only make up 12.5% of all launches the company has conducted for 2021 so far. And only one of those three launches deployed Starlink.

European rocket launcher Arianespace conducted five launches during 3Q21. Three of those launches used the Russian Soyuz from Vostochny and Baikonur Cosmodromes in Russia. It also launched one each of its Ariane 5 and the smaller Vega from Kourou, in French Guiana.

Only two Russian launches were conducted during the third quarter. Roscosmos launched a Proton to deploy an ISS module, while Russia’s military launched a Soyuz. India’s single launch attempt using the GSLV failed.

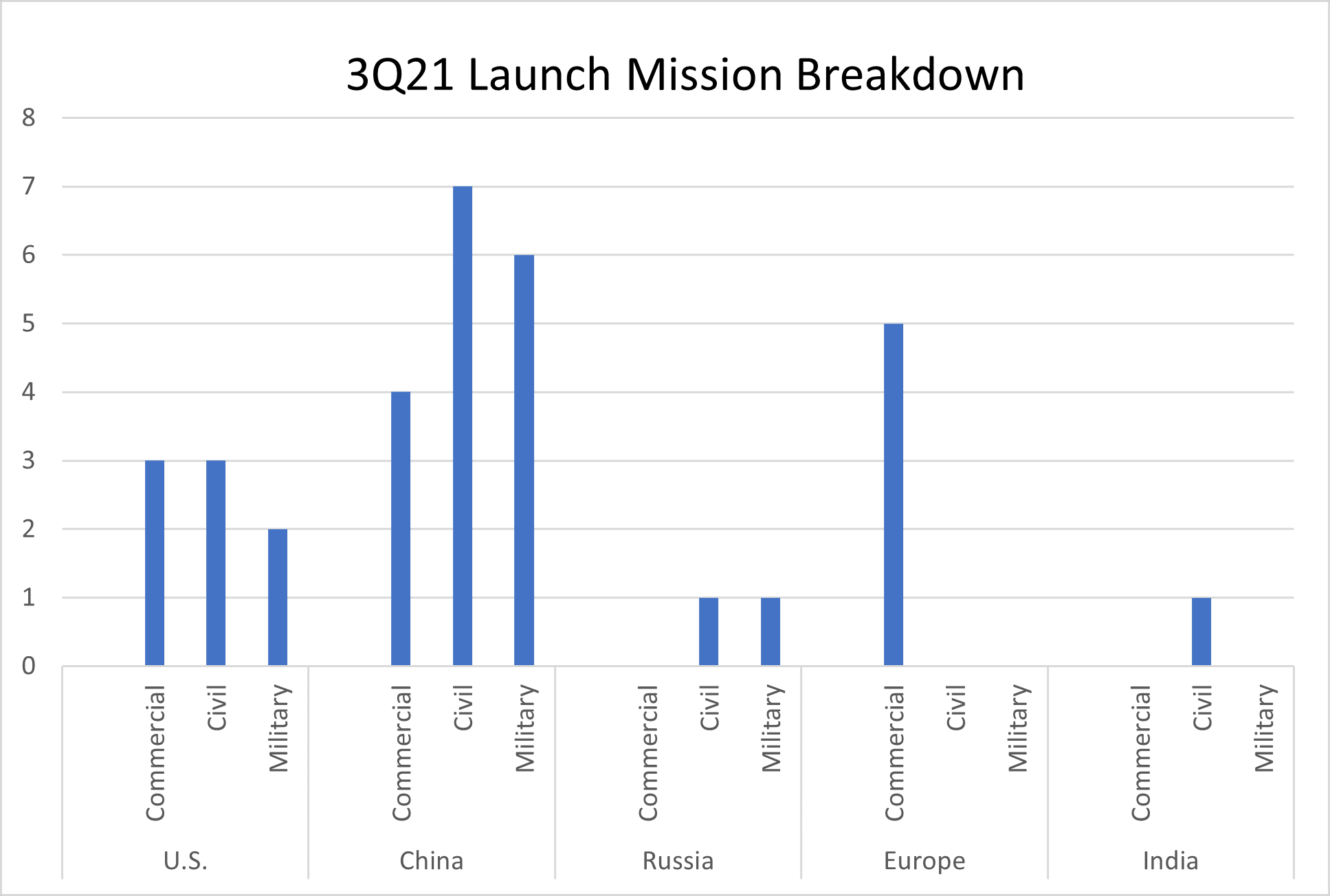

3Q21 Mission Breakdown

I’ve broken down the types of missions driving these launches into three categories (very simply defined):

- Commercial: launches of satellites with a commercial purpose (profit is the priority)

- Civil: launches of satellites with a civil purpose (government-provided public services)

- Military: launches of satellites supporting/augmenting a government’s military

For launches deploying multiple satellites, the assumption is the satellite with the most mass is likely the primary driver for the launch. The assumption means I’m relying on my judgment to determine which satellites may be the primary reason for a launch. The mission breakdown is as follows:

About 36% of all launches conducted during 3Q21 were for civil missions, such as launching passengers or cargo to the ISS, or weather satellites such as Gaofen-5. About 36% of the launches conducted during the quarter were for commercial missions, such as Starlink, Jilin, or a three-day commercial passenger ride around the Earth. Military launches made up the remaining 27% of the missions for the third quarter.

Three of China’s four commercial launch attempts were to deploy Earth observation (EO) satellites in 3Q21. The remaining commercial launch deployed test demonstrators for space-based internet. China’s seven civil launches deployed a mix of space station cargo spacecraft and test, EO, and communications satellites. China’s six military mission launches nearly equaled the nation’s civil launches and deployed EO and communications satellites.

The three U.S. commercial launch attempts during 3Q21 consisted of a Starlink mission, a commercial passenger ride around the Earth, and several commercial cubesats (this was the Firefly failure). Two of the civil launches supported the ISS, and the remaining one was for an EO satellite. Both military missions were to deploy smallsats.

Most of the five European commercial launches during 3Q21 used the Russian Soyuz to deploy the OneWeb constellation. One of the two remaining launches deployed a commercial Earth observation satellite using the Vega, and the Ariane 5 deployed communications satellites in the other launch.

The two 3Q21 launches from Russia were simple. The civil launch deployed an ISS module, while the military launch likely deployed an EO satellite. India’s failed launch attempt would have deployed a civil EO satellite.

Overall, the number of launches in 3Q21 remained about the same as the previous two quarters, but two significant drivers stood out: China and government activities. The difference and the reason why the launch activity stayed about level is that China’s launch providers stepped up in a big way. China’s activities offset the U.S. launch decrease of more than half (compared with the previous few quarters) and Russia’s continued depression in its activities.

Combined government launches (civil and military) made up ~64% of all launch activities, bolstering the industry during the quarter as commercial launches stayed lean. With a single Starlink launch conducted during 3Q21, the accurate baseline for commercial launches comes to the fore, and it doesn’t look great. Does a dependence to shore up commercial launch numbers based on SpaceX and Starlink launches indicate a healthy commercial market? Realistically, there are no equivalent alternatives to SpaceX’s seeming value with its launches, but it will be healthier if another company emerges that can.

Comments ()